IRS Remote File And e-File Free Facilitated Self – Assistance VITA Instructions:

Number 1 Choice Remote Online Filing: Using OnLine Taxes. Let us help you file your own taxes for free. You File, You e-File.

Note:

Our United Way of Siouxland VITA Site Identification Number (SIDN) S26063046 must be included for Free Return.

• OnLine Taxes.

• Eligibility Requirements:

• Any age;

• Adjusted Gross Income (AGI) under $73,000, OR;

• Eligible for EITC, OR;

• Active Duty Military and under $73,000 AGI;

• Free state return if you qualify for a free federal return;

• Log-in Link:

Step 1. – Create OLT ONE Account. You will see our SIDN: S26063046 already entered.

Step 2. – Start new return;

Step 3. – Prepare Federal Return;

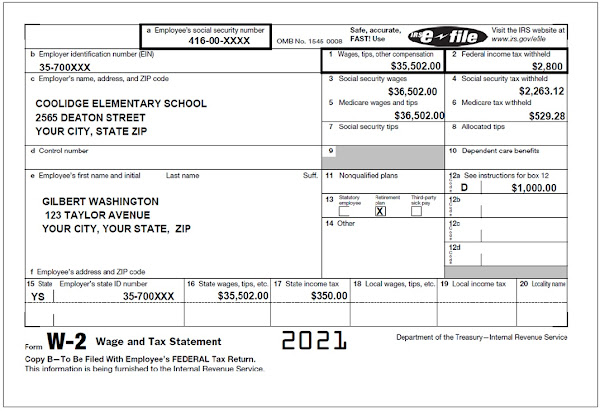

• Enter Income W-2 Form;

• Enter Other Income;

• Enter Deductions for Adjusted Gross Income;

• Enter Standard Deduction;

• Enter Payments;

• Enter Credits;

• Enter Direct Deposit Information if Refund;

• Enter Payment Voucher Amount You Owe;

Step 4. – Prepare State Return;

Number 2 Choice Remote Online Filing: Using TaxSlayer Pro Online. Let us help you file your own taxes for free. You File, You e-File, just by hitting the Transmit button.

For Tax Questions:

A Certified Tax Preparer will assist you with TaxSlayer Pro Online software questions and tax preparation questions via:

1. Phone: call 712-252-1861 x108

2. Email: cfs@centerforsiouxland.org

3. Zoom: Call 712-252-1861 x108 and we will set up a Zoom meeting between you and a Certified Tax Preparer.

For TaxSlayer Pro Software Eligibility Requirements:

1. Adjusted Gross Income (AGI) under $73,000.

2. Free state return if you qualify for a free federal return.

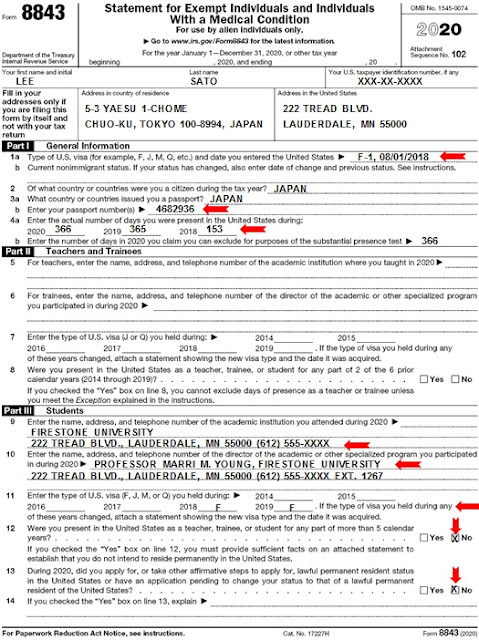

3. Foreign Students and Puerto Rico filers access to prepare and e-file 1040-NR and 1040-PR returns

Log-in Link to TaxSlayer Pro Online::

1. Go to https://myfreetaxes.com/ by clicking on

myfreetaxes.

2. Click on the picture “

File My Own Taxes.” Answer the 3 questions. Click “

File Now.” You will be transferring to TaxSlayer Pro Online using our special referral link so you can file your taxes for free and transfer e-File to IRS for free.

3. If you have previously filed your taxes using TaxSlayer and already have an account, you will be able to use that account with the link above to file your taxes. If not create a new account.

What You Will Need:

1. Income statements like W-2s or 1099s;

2. Adjustments to income;

3. Dependent and spouse information, if applicable;

4. Prior Year AGI or

Prior Year Self-Select PIN.

File your taxes for free. Choose the filing option that works best for you.

1. File My Own Taxes OR

2. Have My Taxes Prepared for Me.

MyFreeTaxes File By Myself.

At the site above, answer three simple questions:

1. Did you earn less than $73,000 in 2022?

2. What is your ZIP code?

3. Do you have income from self-employment?

After answering 3 questions hit the

FILE NOW button. And you will be redirected to

TaxSlayer VITA/TCE self-prep kiosk.

Welcome to the TaxSlayer VITA/TCE self-prep kiosk:

• No current year preparation or e-File Fees;

• Current year states, unlimited;

• Access to prepare and e-file 1040-NR;

• Access to prepare and e-file 1040PR;

• For assistance while completing your return, please contact the free tax assistance program where you received the referral link to this software. They have IRS-certified specialists available to assist you.

• Click the

Continue button to create a new account or login with an existing account.

This is a great opportunity if you:

1. Are filing 2022 tax return;

2. Are comfortable using tax software;

3. If you have previously filed your taxes using TaxSlayer and already have an account, you will be able to use that account with the link above to file your taxes. If not create a new account.