2023 Advanced Course Scenarios Test/Retest Questions – Answers with Solutions;

IRS Started Direct File pilot Software for filing season 2023:

IRS Direct File is one more option from which taxpayers can choose to file a 2023 federal tax return during the 2024 filing season. Free IRS Direct File option to be available for taxpayers in 13 states, California is included.IRS Inflation Adjustments for 2024:

1. Married filing jointly, the Standard Deduction for 2024 rises to $27,700 up $1,800.2. Single and married individuals filing separately, the Standard Deduction rises to $13,850 for 2024, up $900.

3. Heads of households, the Standard Deduction will be $20,800 for tax year 2024, up $1,400.

Get ready to file 2024 returns. Four electronic filing options for individual taxpayers are available and listed below:

1. IRS Free File Fillable Forms, if you are comfortable using tax forms and do your own taxes, and your adjusted gross income is $73,000 or less.2. Free Tax Return Preparation VITA Site.

3. Use Commercial Tax Prep Software (TaxSlayerPre) to prepare and file your taxes.

4. Find an Authorized e-file Provider. Tax pros accepted by IRS electronic filing program are authorized IRS e-file providers. They are qualified to prepare, transmit and process e-filed returns.

Advanced Scenario 1 Sharon Smith-Interview Notes:

• Sharon's husband, Daniel, moved out of their home in February of 2022. Sharon has had no contact with Daniel since he moved out. Sharon and Daniel are not legally separated.• Sharon has one child, Lea, age 10. She will claim Lea as a dependent on her 2024 tax return.

• Sharon is 31 years old.

• Sharon earned $44,500 in wages and received $50 of interest. Sharon had lottery winnings of $2,000 reported on Form W2-G.

• Sharon paid all the costs of keeping up her home. She provided over half of the support for Lea.

• They all are U.S. citizens and have valid social security numbers. They lived in the U.S. all year.

Advanced Scenario 1 Sharon Smith-Test Questions:

1. What is the most beneficial allowable filing status that Sharon is eligible to claim on her 2024 tax return?a. Single

b. Married Filing Separately

c. Qualifying Surviving Spouse (QSS)

d. Head of Household ANSWER

Solution: Even though Sharon is still married to her husband Daniel, she meets the requirements to be considered unmarried for filing status purposes and qualifies to file as Head of Household. Although technically she could file as Married Filing Separately, it would not be to her advantage to do so.

2. Based on the information provided, Sharon qualifies for the earned income credit.

a. True ANSWER

b. False

Solution:

For Sharon to qualify for the EITC, she must have:

1. Have worked and earned income under $46,560 in the tax year 2024.

2. Have investment income no more than $11,000 in the tax year 2024.

3. And have a valid Social Security Number by the due date of her 2024 tax return.

3. Sharon is required to report her lottery winnings as income on her federal tax return.

a. True ANSWER

b. False

Solution:

Lottery winning is taxable income. If you received lottery winning, you generally must include the payments in your income when you file your federal income tax return.

Advanced Scenario 1 Sharon Smith-Retest Questions:

1. Sharon qualifies for Head of Household filing status.a. True ANSWER

b. False

2. Who qualifies to claim the earned income credit for Mary?

a. Sharon ANSWER

b. Morgan

c. Both Lydia and Morgan

d. Neither Lydia nor Morgan

3. Sharon does not need to report her gambling winnings on her federal tax return.

a. True

b. False ANSWER

Advanced Scenario 2 Jeff and Jane Spring-Interview Notes:

• Jeff and Jane are married and want to file a joint return.• Jeff is a U.S. citizen and has a valid Social Security number. Jane is a resident alien and has an ITIN. They resided in the United States all year with their children.

• Jeff and Jane have two children, Joan, age 7, and Jim, age 15. Joan and Jim are U.S. citizens and have valid Social Security numbers.

• Jeff earned $23,000 in wages.

• Jane earned $21,000 in wages.

• In order to work, the Springs paid $2,000 to their son, Jim, to care for Joan after school.

• Jeff and Jane provided all of the support for their two children.

Advanced Scenario 2 Jeff and Jane Spring-Test Questions:

4. What is the maximum amount Jeff and Jane are eligible to claim for the child tax credit?a. $2,000

b. $3,000

c. $4,000 ANSWER

d. $6,000

Solution: The child tax credit (CTC) is a nonrefundable credit that allows taxpayers to claim a tax credit of up to $2,000 per qualifying child.

5. The Springs qualify for the child and dependent care credit.

a. True

b. False ANSWER

Solution:

What if the taxpayer makes payments to a relative? Payments to relatives may qualify as work-related expenses if the taxpayer does not claim the relative as a dependent.

Resources:

Form 2441 and Instructions, Child and Dependent Care Expenses and Publication 503, Child and Dependent Care Expenses.

Advanced Scenario 2 Jeff and Jane Spring-Retest Questions:

4. The maximum amount Jeff and Jane are eligible to claim for the Child Tax Credit is $2,000.a. True

b. False ANSWER

Solution:

The maximum amount taxpayers can claim for the child tax credit is $2,000 for each qualifying child. The amount claimed on Form 1040 depends on the taxpayer’s filing status, modified adjusted gross income (MAGI) and tax liability.

5. Payments made to Jim can be claimed on Form 2441 as child and dependent care expenses.

a. True

b. False ANSWER

Solution:

What if the taxpayer makes payments to a relative? Payments to relatives may qualify as work-related expenses if the taxpayer does not claim the relative as a dependent.

Advanced Scenario 3 Rose Jones-Interview Notes:

• Mary Wood, age 57, is single.• Mary earned wages of $51,000 and was enrolled the entire year in a high deductible health plan (HDHP) with self-only coverage.

• During the year, Mary contributed $2,000 to her Health Savings Account (HSA) and her mother also contributed $1,000 to Mary's HSA.

• Mary's Form W-2 shows $1,150 in Box 12 with code W. She has Form 5498-SA showing $4,150 in Box 2.

• Mary has Form 1099-SA showing her HSA distributions.She used her distributions to pay the following unreimbursed expenses:

o $500 for nine visits to a physical therapist after her knee surgery.

o $1,000 unreimbursed doctor bills. o $280 prescription medicine. o $1,500 replacement of a crown.

o $300 deep cleaning for teeth.

o $40 over the counter medication.

o $260 gym membership (for her general health and fitness).

o Mary is a U.S. citizen with a valid Social Security number.

Advanced Scenario 3 Rose Jones-Test Questions:

7. Form 8889, Part 1 is used to report HSA contributions made by _______________.a. Mary

b. Mary's employer

c. Mary's mother

d. All of the above ANSWER

Solution:

Form 8889, Part 1, is used to report all HSA contributions and to compute the allowable HSA deduction. This includes contributions made by the filing deadline for the tax year. Contributions made by an employer are also shown in Part I, but are not included in the deductible amount.

6. Rose is eligible to contribute an additional $__________ to her HSA because she is age 55 or older. a. $0

b. $850

c. $1,000 ANSWER

d. $2,000

Solution:

Health Savings Account (HSA) Contribution Limits on Deductions;

For 2024, the annual contribution limits on deductions for HSAs for individuals with self-only coverage is $4,150 and $8,300 for family coverage. Reference: IRS 2024 Publication 969.

There is an additional contribution amount of $1,000 for taxpayers who are age 55 or older.

8. What is the total unreimbursed qualified medical expenses reported on Form 8889, Part II?

a. $3,320 ANSWER

b. $3,580

c. $3,620

d. $3,860

Solution:

Gym membership $260 is not a qualified medical expense. You can deduct on Schedule A (Form 1040) only the amount of your medical and dental expenses that is more than 7.5% of your AGI.

You can't include membership dues in a gym, health club, or spa. Even a fee for weight loss program unless prescribed by a doctor.

Reference:

Publication 502, Medical and Dental Expenses.

Advanced Scenario 3 Rose Jones-Retest Questions:

6. Rose cannot include her mother's contribution on Form 8889, Part 1.a. True

b. False ANSWER

Solution:

Family members or any other person may also contribute on behalf of an eligible individual. Contributions to an HSA must be made in cash.

7. Rose is eligible to contribute an additional $2,000 to her HSA because she is age 55 or older.

a. True

b. False ANSWER

8. The over the counter medicine is a qualified medical expense for HSA purposes.

a. True ANSWER

b. False

Solution:

IRS says yes, over the counter medicine is a qualified medical expense for HSA purposes and may be paid or reimbursed by an HSA.

Advanced Scenario 4 Cheryl Brown-Interview Notes:

• Cheryl, age 62, is single. She owns her home and provided all the costs of keeping up her home for the entire year. Her only income for 2024 was $48,700 in W-2 wages.• Cindy, age 24, and her daughter Cary, age 5, have lived with Cindy's mother, Cheryl, since Cindy separated from her spouse in April of 2023. Cindy's only income for 2024 was $24,000 in wages. Cindy provided over half of her own support. Cary did not provide more than half of her own support.

• Cindy will not file a joint return with her spouse.

• All individuals in the household are U.S. citizens with valid Social Security numbers. No one has a disability. They lived in the United States all year.

Advanced Scenario 4 Cheryl Brown-Test Questions:

9. For the purpose of determining dependency, Cary could be the qualifying child of _______________.a. Only Cheryl

b. Only Cindy

c. Either Cheryl or Cindy ANSWER

d. Neither Cheryl nor Cincy

Solution:

To Be a Qualifying Child. What are the rules for a qualifying child of more than one person?

Sometimes a child meets the tests to be a qualifying child of more than one person. A child who meets the conditions to be a qualifying child of more than one person can only be claimed by one taxpayer for the EIC.

10.Cindy is eligible to claim Cary for the earned income credit.

a. True ANSWER

b. False

Solution:

Cindy is eligible to claim Cary for the earned income credit.

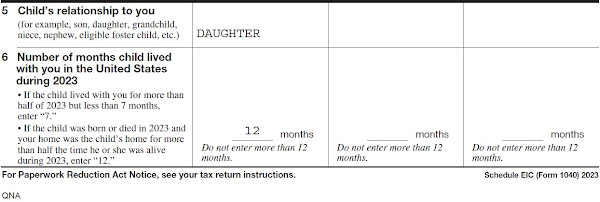

File Schedule EIC Earned Income Credit (Form 1040) if you have a qualifying child even if that child doesn't have a valid SSN.

Reference:

596 2023 IRS Publication Earned Income Credit (EIC).

Advanced Scenario 4 Chery Brown-Retest Questions:

9. Either Cindy or Chery can claim Andrea as a dependent.a. True ANSWER

b. False

10. Which of the following statements is true?

a. Cindy is not eligible to claim Cary for the EIC because her filing status is married filing separate.

b. Cindy is not eligible to claim the EIC for Cary because she is under age 25.

c. Cindy is not eligible to claim Cary for the EIC because her income is too high.

d. None of the above statements is true. ANSWER

Advanced Scenario 5 Elizabeth Greene-Interview Notes:

• Elizabeth is 48 years old and files as single.• Her 2024 adjusted gross income (AGI) is $51,000, which includes gambling winnings of $2,000.

• Elizabeth would like to itemize her deductions this year.

• Elizabeth brings documents for the following expenses:

o $9,500 Hospital and doctor bills.

o $600 Contributions to Health Savings Account (HSA).

o $3,600 State withholding (higher than Helen's calculated state sales tax deduction).

o $300 Personal property taxes based on the value of the vehicle.

o $400 Friend’s personal GoFundMe campaign.

o $350 Cash contributions to the Red Cross.

o $200 Fair market value of clothing in good condition donated to the Salvation Army (Helen purchased clothing for $900).

o $7,300 Mortgage interest.

o $2,300 Real estate tax.

o $1,500 Homeowners association fees.

o $4,000 Gambling losses.

Advanced Scenario 5 Elizabeth Greene-Test Questions:

11. Elizabeth can claim the $1,500 Homeowners association fees as a deduction on her Form 1040, Schedule A.a. True

b. False ANSWER

Solution:

Real estate taxes; some real estate taxes or charges that may be included on the real estate tax bill are not deductible. These include homeowners’ association fees.

12. What amount of gambling losses is Elizabeth eligible to claim as a deduction on her Form 1040, Schedule A?

a. $0

b. $1,000

c. $2,000 ANSWER

d. $3,000

Solution:

What miscellaneous expenses are deductible?

Examples of miscellaneous itemized deductions include:

Gambling losses and expenses (through 2024) to the extent of gambling winnings (taxpayers must have a record of their losses).

Advanced Scenario 5 Elizabeth Greene-Retest Questions:

11. If Elizabethn chooses to itemize, which of the following is she not eligible to claim as a deduction on Form 1040, Schedule A?a. $7,300 mortgage interest

b. $1,500 Homeowner's Association fees ANSWER

c. $2,300 real estate tax

d. $350 contribution to the Red Cross

12. Elizabeth is eligible to claim $2,000 in gambling losses as a deduction on her Form 1040, Schedule A.

a. True ANSWER

b. False

Advanced Scenario 6 David Stone-Interview Notes:

• David Stone is 28 years old and single. He provides all of his own support.• David works at a gas station and earned $18,500 in wages.

• David took two management courses at a community college to improve his job skills. He was less than a half time student. He He wants to know if that qualifies for any educational tax benefit.

• David took an early distribution from his IRA of $2,000 for tuition and $500 for emergency repairs of his air conditioning system. This is the first time he has taken a distribution from his IRA. • David is a U.S. citizen and lived in the U.S. for the entire year. He has a valid Social Security number.

Advanced Scenario 6 David Stone-Test Questions:

13. David is eligible to claim the American Opportunity Credit on his 2024 tax return.a. True

b. False ANSWER

Solution:

To be eligible for AOTC, the student must:

1. Be pursuing a degree or other recognized education credential.

2. Be enrolled at least half time for at least one academic period* beginning in the tax year.

3. Not have finished the first four years of higher education at the beginning of the tax year.

Reference:

IRS Publication 970, Tax Benefits for Education.

14. For which of the following IRA distributions will David owe an additional tax of 10%.

a. $2000 for tuition.

b. $500 for emergency repares. ANSWER

c. Both a and b.

d. Neither a nor b.

Solution:

The additional tax is equal to 10% of the portion of the distribution that's includible in gross income.

Reference:

IRS 2024 Topic no. 557, Additional tax on early distributions from traditional and Roth IRAs.

Advanced Scenario 6 David Stone-Retest Questions:

13. David's modified adjusted gross income (MAGI) must be less than $90,000 to claim the Lifetime Learning Credit in 2024.a. True ANSWER

b. False

14. David will owe an additional $50 tax on the $500 IRA distribution for emergeny repair?

a. True ANSWER

b. False

Advanced Scenario 7 Vincent and Faith Hunter – Interview Notes:

• Vincent is a 5th grade teacher at a public school. Vincent and Faith are married and choose to file Married Filing Jointly on their 2024 tax return.• Vincent worked a total of 1,800 hours in 2024. During the school year, he spent $844 on unreimbursed classroom expenses.

• Faith retired in 2021 and began receiving her pension on November 1st of that year. She explains that this is a joint and survivor annuity. She has already recovered $1,259 of the cost of the plan.

• Vincent settled with his credit card company on an outstanding bill and brought the Form 1099-C to the site. They aren’t sure how it will impact their tax return for tax year 2024. The Hunters determined that they were solvent as of the date of the canceled debt.

• Faith received $280 from Jury duty.

• Their daughter, Hope, is in her second year of college pursuing a bachelor’s degree in Physics at a qualified educational institution. She received a scholarship and the terms require that it be used to pay tuition. Box 2 was not filled in and Box 7 was not checked on her Form 1098-T for the previous tax year. The Hunters provided Form 1098-T and an account statement from the college that included additional expenses. The Hunters paid $1500 for books and equipment required for Hope's courses. This information is also included on the college statement of account. The Hunters claimed the American Opportunity Credit last year for the first time.

• Hope does not have a felony drug conviction.

• They are all U.S. citizens with valid Social Security numbers.

2024 Faith Hunter’s FEDERAL TAX RETURN DOCUMENTS:

FORM W-2 Wages: 1. Wages $37,353, 2. Federal Tax Withheld $3200, 17. State Tax $500

FORM 1099-R Annuities: 1. Gross Distribution $20,100, 4. Federal Tax Withheld $2010, 7. Distribution Code 7, 9b. Total Employee Contribution $15,000

FORM SSA-1099 Social Security Bemefit: 5. Net Benefit $23,899, 6. Federal Tax Withholding $2390

FAITH HUNTER'S TOTAL TAX = $7600 ($2390 + $2010 + $3200)

FAITH HUNTER'S TOTAL INCOME = 75486 (37353 + 19419 + 1050 + 19464)

INCOME:

W-2 35353 (12A. D 1000 EMPLOYEE RETIREMENT CONTRIBUTION)

1099-R 19419 INCOME

1099-C 850 INCOME (CANCELLATION OF DEPT SCH1 LINE 8C)

JURY 280 SCHEDULE 1 LINE 8H

SSA-1099 19464 (22899X.85=19464 TAXABLE INCOME)

TOTAL INCOME 75486 – 300 EDUCATOR EXPENSES = 75186 ADJUSTED INCOME LINE 11

MINUS 29200 = 45986 TAXABLE INCOME (F1040 LINE 15

TAX FROM TAX TABLE 5077

5077-(500 CREDIT FOR OTHER DEP+1393 SCH3 LINE 8) = 3184

3184 THIS IS YOUR TOTAL TAX (F1040 LINE 24)

TOTAL PAYMENTS 7490 + 928 = 8418 (F1040 LINE 33)

REFUND TO YOU 8418 – 3184 = 5234 (SUBTRACT LINE 24 FROM LINE 33)

PAYMENTS 1040 LINE 29 (981) (FROM FORM 8863 LINE 8)

EDUCATION CREDITS F8863 LINE 8 928 AND Form 1040 LINE 29

CREDIT Amount from Schedule 3, line 3 1393 (F8863 LINE 19 1393) F1040 Line 20

Advanced Scenario 7 Matthew and Rebecca Monroe – Test Questions:

15. What is the taxable portion of Rebecca's pension from Riverside Enterprises using the simplified method?a. $0

b. $18,741

c. $19,419 ANSWER

d. $20,000

SOLUTION:

1963 Taxpayer Born 1954 Spouse Born

2023-1963=60 Taxpayer’s Age

2023-1954=69 Spouse’s Age

69+60=129-3=126 Combine Age at 2020 Pension Start Date (2023-2020=3) from table 2 for Line 3 = 310

Simplified Method Worksheet – Lines 5a and 5b 16. All of Rebecca’s social security benefits are taxable according to the social security benefits worksheet.

a. True

b. False ANSWER

17. What is the total amount of other income reported on the Monroe's Form 1040, Schedule 1?

a. $200

b. $850

c. $1,050 ANSWER

d. $4,152

SOLUTION:

$850 Cancelled Debt + $200 Jury Duty = 1050.

18. Matthew is eligible to deduct qualified educator expenses in the amount of $____________. 300 ANSWER

SOLUTION:

1. Eligible educators can deduct up to $300 of qualified expenses paid during the tax year. An eligible educator is a kindergarten through grade 12 teacher, who worked in a school for at least 900 hours during a school year.

2. If you were an eligible educator in 2023, you can deduct qualified expenses up to $300 you paid in2023 in the Adjustments to Income section of Schedule 1 (FORM 1040), Line 11.

19. What is the Monroe's standard deduction on their 2023 tax return?

a. $20,800

b. $27,700

c. $29,200 ANSWER

d. $30,700

20. Which of the following expenses qualify for the American opportunity credit?

a. Required course related books and equipment

b. Tuition

c. Parking pass

d. Both a and b ANSWER

21. The Monroes are eligible to claim the credit for other dependents on their tax return.

a. True ANSWER

b. False

22. What is the Monroe’s total federal income tax withholding?

a. $5,200

b. $5,490

c. $6,200

d. $7,490 ANSWER

SOLUTION:

$7,490 (3,200 + 2,000 + 2.290)

Advanced Scenario 7 Matthew and Rebecca Monroe – Retest Questions:

15. The taxable portion of Rebecca's pension from Riverside Enterprises using the simplified method is $19,419.a. True ANSWER

b. False

16. The taxable amount of Rebecca's social security income is:

a. $0

b. $18,630

c. $19,464 ANSWER

d. $22,899

17. The total amount of other income reported on the Monroe's Form 1040, Schedule 1 is $1,050.

a. True ANSWER

b. False

SOLUTION: Cancellation of debt $850 Jury duty pay $200.

18. What is the amount Matthew is eligible to claim as qualified educator expenses on Form 1040, Schedule 1?

a. $0

b. $250

c. $300 ANSWER

d. $733

SOLUTION:

1. Eligible educators can deduct up to $300 of qualified expenses paid during the tax year. An eligible educator is a kindergarten through grade 12 teacher, who worked in a school for at least 900 hours during a school year.

2. If you were an eligible educator in 2023, you can deduct qualified expenses up to $300 you paid in 2023 in the Adjustments to Income section of Schedule 1 (FORM 1040), Line 11.

19. The Monroe's standard deduction on their Form 1040 for tax year 2023 is $27,700.

a. True

b. False ANSWER

20. Which is not a qualifying expense for the American opportunity credit?

a. Parking pass ANSWER

b. Required course related books

c. Tuition

d. Required course related equipment

21. Which of the following credits are the Monroes able to claim on their federal tax return?

a. Earned Income Credit

b. American Opportunity Credit ANSWER

c. Child Tax Credit

d. Premium Tax Credit

SOLUTION:

1. Taxpayers can take education credits for themselves, their spouse or dependents, claimed on the tax return, who were enrolled and attended an eligible postsecondary educational institution during the tax year.

2. The IRS tax law requires that the student must generally receive a Form 1098-T, Tuition Statement, in order for the taxpayers to claim the education credit.

22. The federal income tax withholding reported on the Monroe's Form 1040 is $5,200.

a. True

b. False ANSWER

SOLUTION:

$7,490 (3,200 + 2,000 + 2.290)

Advanced Scenario 7 Matthew and Rebecca Monroe-1040 2023 RETURN PAGE 1 2 AND 3 using free TaxSlayer-Pro Practice Lab Software:

Schedule 1 line 10=$850, Schedule 3 line 8=$1393, Schedule 8812=$500, Form 8863 line 8=$928, Total Tax line 24 $3172, Total Payments line 33=$8418, Refund: $8418 Subtract $3172=$5246:

Advanced Scenario 8 Julia Oakley-Interview Notes:

• Julia is a data entry clerk, age 26, and single.• Julia has investment income and a consolidated broker’s statement.

• Julia is self-employed delivering groceries for Quick Market on the weekends. She received a Form 1099-NEC and a Form 1099-K. She received additional cash payments of $535.

• Julia uses the cash method of accounting. She uses business code 492000.

• Julia provided a statement from the grocery delivery service indicating the fees paid for the year. These fees are considered ordinary and necessary for the grocery delivery business:

o $150 for insulated box rental

o $50 for vehicle safety inspection (required by Quick Market)

o $600 for Quick Market fees

• Julia also kept receipts for the following out-of-pocket expenses:

o $80 for business parking

o $300 for speeding ticket

o $160 for Julia's lunches

• Julia’s record keeping application shows she has driven a total of 2,500 miles during and between deliveries.

o She placed her only vehicle, an SUV, in service on 3/15/2020. The total mileage on her SUV for tax year 2023 was 12,000 miles. Of that, 9,500 miles were personal and commuting miles. Julia will take the standard business mileage rate.

• Julia is paying off her student loan from 2017, when she completed her undergraduate degree.

• Julia is working towards her Master of Education degree to start a new career as an Associate Professor. She took a few college courses this year at an accredited college.

• Julia took an early distribution of $3,000 from her IRA in April. She used $2,400 of the IRA distribution to pay her educational expenses for the current year.

• If Julia has a refund, she would like it deposited into her checking account.

Advanced Scenario 8 Julia Oakley-Test Questions:

23. What is the net long term capital gain reported on Julia's Schedule D?a. $350

b. $2,100

c. $2,450 ANSWER

d. $6,100

24. Which of the following can be claimed as a business expense on Julia's Schedule C?

a. Business Parking ANSWER

b. Speeding Ticket

c. Lunches

d. All of the above

25. Julia can take a student loan interest deduction of $3,250. a. True

b. False ANSWER

26. What is the total standard mileage deduction for her business on Schedule C? a. $983

b. $1,638 ANSWER

c. $2,500

d. $2,518

27. The amount of Julia's lifetime learning credit is $480.

a. True ANSWER

b. False

28. What is Julia's additional 10% tax on the early withdrawal from her IRA?

a. $0

b. $60 ANSWER

c. $240

d. $300

29. How can Julia prevent having a balance due next year?

a. She can increase the withholding on her Form W-4.

b. She can make estimated tax payments.

c. She can use the IRS withholding calculator to estimate her withholding for next year.

d. All of the above ANSWER

Advanced Scenario 8 Julia Oakley-Retest Questions:

23. Julia's net long term capital gain reported on Schedule D is $1,700. a. True

b. False ANSWER

24. Julia can claim the speeding ticket as a business expense on her Schedule C.

a. True

b. False ANSWER

25. What is the amount Julia can take as a student loan interest deduction on her Form 1040, Schedule 1?

a. $0

b. $750

c. $2,500 ANSWER

d. $3,250

26. The total standard mileage deduction for Julia's business on Schedule C is $983.

a. True

b. False ANSWER

27. Julia meets the qualifications to claim the American Opportunity Credit.

a. True

b. False ANSWER

28. Julia will have to pay $60 additional tax because she received the early distribution from her IRA.

a. True ANSWER

b. False

29. Julia can make estimated tax payments to avoid owing tax next year.

a. True ANSWER

b. False

FORM 1040 PAGE1

FORM 1040 PAGE2

1. SCHEDULE 1 – PART I (ADDITIONAL INCOME) TOTAL ADDITIONAL INCOME LINE 10 =4549 (on FORM 1040 LINE 8 ENTER 4549):

2. SCHEDULE 1 – PART II (ADJUSTMENTS TO INCOME) TOTAL ADJUSTMENTS TO INCOME LINE 26 =2822 (on FORM 1040 LINE 10 ENTER 2822):

3. SCHEDULE 2 – PART II (OTHER TAXES) TOTAL OTHER TAXES LINE 21 =703 (on FORM 1040 LINE 23 ENTER 703):

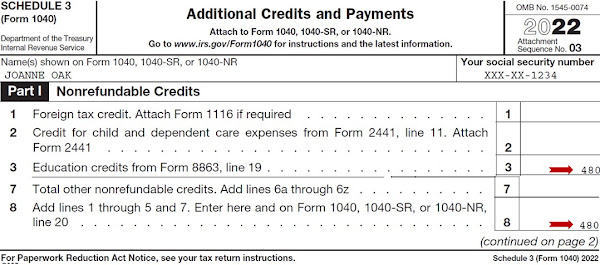

4. SCHEDULE 3 – PART I (NONREFUNDABLE CREDITS) LINE 8 =480 (on FORM 1040 LINE 20 ENTER 480):

5A. SCHEDULE B (INTEREST)LINE 4 =15 (on FORM 1040 LINE 2b ENTER 15):

5B. SCHEDULE B (ORDINARY DIVIDENTS) LINE 6 =300 (on FORM 1040 LINE 3b ENTER 300):

6. SCHEDULE C (BUSINESS INCOME)LINE 31 =4549 ENTER on BOTH SCHEDULE 1 LINE 3 =4549 AND on SCHEDULE SE LINE 2 =4549 (on FORM 1040 LINE 8 ENTER 4549):

7A. SCHEDULE D (CAPITAL GAINS/LOSSES) – PART I SHORT-TERM LOSS: LINE 7 =-750:

7B. SCHEDULE D (CAPITAL GAINS/LOSSES) – PART II LONG-TERM GAIN LINE 15 =2450:

7C. SCHEDULE D (CAPITAL GAINS/LOSSES) – PART III SUMMARY LINE 16 =1700 (2450-750=1700) (on FORM 1040 LINE 7 ENTER 1700):

8. SCHEDULE SE (SELF-EMPLOYMENT TAX) LINE 12 =643 (on SCHEDULE 2 LINE 4 ENTER 643) AND LINE 13 =322 DEDUCTION FOR ONE-HALF OF SE TAX (on SCHEDULE 1 LINE 15 ENTER 322) AND (on FORM 1040 LINE 23 ENTER 703 FROM SCHEDULE 2 LINE 21):

9. FORM 5329 (TAX ON EARLY RETIREMENT DISTRIBUTIONS)

10. FORM 8863 (EDUCATIOANAL DREDITS) – PART II (NONREFUNDABLE EDUCATION CREDUTS) LINE 19 =480 (on SCHEDULE 3 LINE 3 ENTER 480) FROM SCHEDULE 3 LINE 8 =480 (on FORM 104O LINE 29 ENTER 480:

11. FORM 8995 (QUALIFIED BUSINESS INCOME DEDUCTION) LINE 15 =851 (on FORM 1040 LINE 13 ENTER 851:

Advanced Scenario 8 Julia Oakley-1040 2023 RETURN PAGE 1 AND 2 using free TaxSlayer Pro-Practice Lab Software:

1. OAKLEY SCHEDULE 1 – PART I (ADDITIONAL INCOME) TOTAL ADDITIONAL INCOME LINE 10 =4549 (on FORM 1040 LINE 8 Enter 4549):

2. SCHEDULE 1 – PART II (ADJUSTMENTS TO INCOME) TOTAL ADJUSTMENTS TO INCOME LINE 26 =2822 (on FORM 1040 LINE 10 ENTER 2822):

3. SCHEDULE 2 – PART II (OTHER TAXES) TOTAL OTHER TAXES LINE 21 =703 (on FORM 1040 LINE 23 ENTER 703):

4. SCHEDULE 3 – PART I (NONREFUNDABLE CREDITS) LINE 8 =480 (on FORM 1040 LINE 20 ENTER 480):

5A. SCHEDULE B (INTEREST) LINE 4 =15 (on FORM 1040 LINE 2b ENTER 15:

5B. SCHEDULE B (ORDINARY DIVIDENTS) LINE 6 =300 (on FORM 1040 LINE 3b ENTER 300:

6. SCHEDULE C (BUSINESS INCOME) LINE 31 =4549 ENTER on BOTH SCHEDULE 1 LINE 3 =4549 AND on SCHEDULE SE LINE 2 =4549 (on FORM 1040 LINE 8 ENTER 4549):

7A. SCHEDULE D (CAPITAL GAINS/LOSSES) – PART I SHORT-TERM CAPITAL LOSS LINE 7 =-750:

7B. SCHEDULE D (CAPITAL GAINS/LOSSES) – PART II LONG-TERM GAIN LINE 15 =2450:

7C. SCHEDULE D (CAPITAL GAINS/LOSSES) – PART III SUMMARY LINE 16 =1700 (2450-750=1700) (on FORM 1040 LINE 7 ENTER 1700):

8. SCHEDULE SE (SELF-EMPLOYMENT TAX)LINE 12 =643 (on SCHEDULE 2 LINE 4 ENTER 643) AND LINE 13 =322 DEDUCTION FOR ONE-HALF OF SE TAX (on SCHEDULE 1 LINE 15 ENTER 322) AND (on FORM 1040 LINE 23 ENTER 703 FROM SCHEDULE 2 LINE 21):

9. FORM 5329 (TAX ON EARLY RETIREMENT DISTRIBUTIONS) LINE 4 =60 (on SCHEDULE 2 LINE 8 ENTER 60):

10. FORM 8863 (EDUCATIOANAL DREDITS) – PART II (NONREFUNDABLE EDUCATION CREDUTS) LINE 19 =480 (on SCHEDULE 3 LINE 3 ENTER 480) FROM SCHEDULE 3 LINE 8 =480 (on FORM 104O LINE 29 ENTER 480:

11. FORM 8995 (QUALIFIDE BUSINESS INCOME DEDUCTION) LIND 15 =851 (on FORM 1040 LINE 13 ENTER 851):

NOTE FOR LINE 1i AND COLUMN c) Qualified business income or (loss):NET PROFIT FROM SCHEDULE C =4549 MINUS DEDUCTIBLE Self-Employment TAX =322 (4549-322 = 4227).

Advanced Scenario 9 David MacLee-Interview Notes:

• David is age 40 and was widowed in July, 2022. He has a daughter, Linda, age 8, who lived with him the entire year. • David provided the entire cost of maintaining the household and over half of the support for Linda. In order to work, he pays childcare expenses to Uptown Daycare. • David purchased health insurance for himself and his daughter through the Marketplace. He received a Form 1095-A. • David and Linda are U.S. citizens and lived in the United States all year in 2023.Advanced Scenario 9 David MacLee-Test Questions:

30. What is David's most advantageous filing status?a. Single

b. Married Filing Separately

c. Head of Household

d. Qualifying Surviving Spouse (QSS) ANSWER

31. David MacLee's adjusted gross income on his Form 1040 is _______.

a. $8,404

b. $36,000

c. $36,104 ANSWER

d. $36,130

32. David cannot claim which of the following credits on his tax return.

a. Child Tax Credit

b. Credit for Other Dependents ANSWER

c. Premium Tax Credit

d. Child and Dependent Care Credit

33. David's retirement savings contributions credit on Form 8880 is $________. 100 ANSWER

34. The total amount of David's net premium tax credit on Form 1040 Schedule 3, line 9 is $696.

a. True ANSWER

b. False

35. David's child and dependent care credit from Form 2441 is reported as a non-refundable credit on Form 1040, Schedule 3.

a. True ANSWER

b. False

Advanced Scenario 9 David MacLee-Retest Questions:

30. David is eligible to claim the Qualifying Surviving Spouse filing status.a. True ANSWER

b. False

31. David's adjusted gross income is $36,130.

a. True

b. False ANSWER

32. David is eligible to claim the child tax credit.

a. True ANSWER

b. False

33. David qualifies to claim a retirement savings contribution credit.

a. True ANSWER

b. False

34. David's net premium tax credit on his Schedule 3, line 9 is $_______. 696 ANSWER

35. David's child and dependent care credit is refundable in 2023.

a. True

b. False ANSWER

Taxpayers with children under the age of 17 may be eligible to claim a tax credit of up to $2,000 per qualifying dependent. For 2023, $1,600 of the credit is potentially refundable. We'll cover who qualifies, how to claim it.

Advanced Scenario 9 David MacLee-1040 2023 RETURN PAGE 1 AND 2 using free TaxSlayer Pro-Practice Lab Software:

2023 1040 LINE 16 843 TAX ON 8404 INCOME MACLEE:

2023 MACLEE 1040 LINE 19 Child tax credit or credit for other dependents from SCHEDULE 8812 LINE 14:

2023 MACLEE 1040 LINE 27 EARNED INCOME CREDIT (EIC) SCHEDULE EIC QUALIFYING CHILD INFORMATION:

2023 MACLEE 1040 LINE 27 EARNED INCOME CREDIT (EIC) Worksheet A—2023 EIC—Line 27:

2023 1040 MACLEE SCHEDULE 8812 LINE 13 Enter the amount from Credit Limit Worksheet A:

2023 MACLEE 1040 LINE 28 ADDITIONAL CHILD TAX CREDIT FROM SCHEDULE 8812 PAGE 2 LINE 27:

2023 DAVID MACLEE 1040 SCHEDULE 1 ADJUSTMENTS AND SCHEDULE 3 CREDITS:

SCHEDULE 3 NONREFUNDABLE CREDITS 2023:

2441 LINE 2 SCHEDULE 3 Credit for child and dependent care expenses from Form 2441, line 11. Attach Form 2441.8880 LINE 4 SCHEDULE 3 Retirement savings contributions credit. Attach Form 8880.

SCHEDULE 3 REFUNDABLE CREDITS 2023:

8962 LINE 9 SCHEDULE 3 Net premium tax credit. Attach Form 8962.2023 Advanced Exam Score 94.29% Proof:

2023 Advanced Exam Incorrect Quesitions:

23. What is the net long term capital gain reported on Julia’s Schedule D?$2,100 Incorrect Answer: $2100+$350=$2450 Correct Answer.

Review the Publication 4491, Capital Gains and Losses lesson and

Publication 4012 Tab D, Capital Gains and Losses.

26. What is the total standard mileage deduction for her business on Schedule C?

$2,500 Incorrect Answer: 2500x0.655=$1,638 Correct Answer.

65.5 cents per mile driven for business use.

Review the Publication 4491, Business Expenses lesson and

Publication 4012 Tab D, Income, Schedule C – Car and Truck Expenses.

=100% Pass.

2022 Advanced Course Scenarios Test/Retest Questions – Answers with Solutions;

2022 Advanced Test/Retest – 100% Pass Proof;

Advanced Scenarios 1 through 9 – Test/Retest Questions;

The first six scenarios do not require you to prepare a tax return. Read the interview notes for each scenario carefully and use your training material IRS Publication 4491 2022 VITA Training Guide, and your resource material IRS Publication 4012 2022 VITA Resource Guide to answer the questions after the scenarios.

Chris Spalding – Interview Notes: • Chris’s husband, George, moved out of their home in February of 2022. She had no contact with him since he moved out. Chris and George are not legally separated.

• Chris has one child, Mary, age 9. She will claim Mary as a dependent on her 2022 tax return. Chris is 31 years old.

• Chris earned $36,200 in wages and received $50 of interest. Chris was out of work for a month and received unemployment income of $1,800.

• Chris paid all the costs of keeping up her home. She provided over half of the support for Mary.

• They all are U.S. citizens and have valid social security numbers. They lived in the U.S. all year.

Chris Spalding – Test Questions;

1. What is the most beneficial of the following filing statuses that Chris is eligible to claim on her 2022 tax return?a. Single

b. Married Filing Separately

c. Qualifying Surviving Spouse (QSS)

d. Head of Household Answer

Chris Spalding – Question 1 Explanation:

The question 1 correct answer is Head of Household. Even though Chris is still married to her husband, she meets the requirements to be “considered unmarried” for filing status purposes and qualifies to file as Head of Household. Although technically she could file as Married Filing Separately, it would not be to her advantage to do so.

2. Based on the information provided, Chris qualifies for the earned income credit.

a. True Answer b. False

Chris Spalding – Question 2 Explanation:

For Chris Spalding to qualify for the EITC, she must have: Have worked and earned income under $57,414. Have investment income below $10,000 in the tax year 2022. And have a valid Social Security Number by the due date of her 2022 tax return.

3. What amount of Chris's unemployment compensation is taxable? $______________.

$1,800 Answer. Chris Spalding – Question 3 Explanation:

Unemployment compensation is taxable income. If you receive unemployment benefits, you generally must include the payments in your income when you file your federal income tax return.

Chris Spalding – Retest Questions;

Chris Spalding – Retest Questions;

1. Chris's most beneficial allowable filing status is Single.a. True b. False Answer

Chris Spalding – Retest Question 1 Explanation:

Although she could file as Married Filing Separately, it would be not to her advantage.2. Mary is a qualifying child for the earned income credit.

a. True Answer b. False

Chris Spalding – Retest Question 2 Explanation:

To qualify for the EITC, a qualifying child must:

- Your child must have Valid Social Security Number for employment.

- Your child must be under age 19 at the end of the year and younger than you.

- Your child must be your Son, daughter, stepchild, adopted child or foster child.

- Your child must live in the same home as you in the United States for more than half of the tax year.

a. True Answer b. False

Chris Spalding – Retest Question 3 Explanation:

Unemployment compensation is taxable income. If you receive unemployment benefits, you must include the payments in your income when you file your federal income tax return.

• Adam and Lisa are married and want to file a joint return.

• Adam is a U.S. citizen and has a valid Social Security number. Lisa is a resident alien and has an ITIN. They resided in the United States all year with their children.

• Adam and Lisa have two children, Maria, age 11, and Luis, age 17. Maria and Luis are U.S. citizens and have valid Social Security numbers.

• Adam earned $22,000 in wages.

• Lisa earned $20,000 in wages.

• In order to work, the Garcias paid $2,000 to their son Luis to care for Maria after school.

• Adam and Lisa provided all of the support for their two children.

Adam and Lisa Garcia – Test Questions;

4. What is the maximum amount Adam and Lisa are eligible to claim for the child tax credit?a. $2,000 Answer

b. $3,000

c. $4,000

d. $6,000

Adam and Lisa Garcia – Question 4 Explanation:

- Child tax credit (CTC) is not refundable.

- 2022 CTC is $2,000 for each qualifying child.

- Must have a Social Security number that is valid for employment issued before the due date of the return, including extensions.

- A child must be under age 17 at the end of 2022 to be a qualifying child.

a. True b. False Anawer

Adam and Lisa Garcia – Question 5 Explanation:

IRS Topic No. 602 Child and Dependent Care Credit:

Payments to Relatives or Dependents – The care provider can't be your spouse, the parent of your qualifying individual if your qualifying individual is your child and under age 13, your child who is under the age of 19, or a dependent whom you or your spouse may claim on your return.

Can a family member get paid for childcare IRS?

These payments may be qualified childcare expenses if the family member babysitting isn't your spouse, the parent of the child, your dependent, or your child under age 19, and if you otherwise qualify to claim the child and dependent care credit.

Adam and Lisa Garcia Interview Notes:

• Adam and Lisa are married and want to file a joint return.• Adam is a U.S. citizen and has a valid Social Security number. Lisa is a resident alien and has an ITIN. They resided in the United States all year with their children.

• Adam and Lisa have two children, Maria, age 11, and Luis, age 17. Maria and Luis are U.S. citizens and have valid Social Security numbers.

• Adam earned $22,000 in wages.

• Lisa earned $20,000 in wages.

• In order to work, the Garcias paid $2,000 to their son Luis to care for Maria after school.

• Adam and Lisa provided all of the support for their two children.

Adam and Lisa Garcia – Retest Questions:

4. The maximum amount Adam and Lisa are eligible to claim for the Child Tax Credit is $4,000.a. True b. False Answer

Adam and Lisa Garcia – Test Question 4 Explanation:

Child tax credit (CTC) is not refundable. 2022 CTC is $2,000 for each qualifying child. Must have a Social Security number that is valid for employment issued before the due date of the return, including extensions. A child must be under age 17 at the end of 2022 to be a qualifying child.

5. Payments made to Luis can be claimed on Form 2441 as child and dependent care expenses.a. True b. False Answer

Adam and Lisa Garcia – Question 5 Explanation:

irs Topic No. 602 Child and Dependent Care Credit:

Payments to Relatives or Dependents – The care provider can't be your spouse, the parent of your qualifying individual if your qualifying individual is your child and under age 13, your child who is under the age of 19, or a dependent whom you or your spouse may claim on your return.

• Jenny Smith, age 57, is single.

• Jenny earned wages of $52,000 and was enrolled the entire year in a high deductible health plan (HDHP) with self-only coverage.

• During the year, Jenny contributed $2,000 to her Health Savings Account (HSA) and her mother also contributed $1,000 to Jenny's HSA account.

• Jenny's Form W-2 shows $650 in Box 12 with code W. She has Form 5498-SA showing $3,650 in Box 2.

• Jenny took a distribution from her HSA to pay her unreimbursed expenses:

o 8 visits to a physical therapist after her knee surgery $400

o unreimbursed doctor bills for $900

o prescription medicine $200

o replacement of a crown $1,500

o over the counter medication $40

o gym membership $240

• Jenny is a U.S. citizen with a valid Social Security number.

Jenny Smith – Test Questions:

6. Form 8889, Part 1 is used to report HSA contributions made by _______________.a. Jenny

b. Jenny's employer

c. Jenny's mother

d. All of the above Answer

Jenny Smith – Question 6 Explanation:

7. Jenny is eligible to contribute an additional $1,000 to her HSA because she is age 55 or older.

a. True Answer b. False

Jenny Smith – Question 7 Explanation:

8. What is the total unreimbursed qualified medical expenses reported on Form 8889, Part II?a. $2,640

b. $3,000

c. $3,040 Answer

d. $3,280

Jenny Smith – Question 8 Explanation:

2022 Publication 502 You can't include membership dues in a gym, health club, or spa as medical expenses, but you can include separate fees charged there for weight loss activities.

Jenny Smith – Retest Question:

6.Jenny can include her mother's contribution on Form 8889, Part 1.a. True Anawer b. False

Jenny Smith Retest Question 6 – Explanation:

7. Jenny is eligible to contribute an additional $_________________ 1000 to her HSA because she is age 55 or older.Jenny Smith – Retest Question 7 Explanation:

Those 55 and older can contribute an additional $1,000 as a catch-up contribution.

8. The gym membership is a qualified medical expense for HSA purposes.a. True b. False Answer

• Alice, age 58, is single. She owns her home and provided all the costs of keeping up her home for the entire year. Her only income for 2022 was $46,000 in W-2 wages.

• Linda, age 24, and her daughter Nancy, age 4, moved in with Linda's mother, Alice, after she separated from her spouse in April of 2020. Linda's only income for 2022 was $25,000 in wages. Linda provided over half of her own support. Nancy did not provide more than half of her own support.

• Linda will not file a joint return with her spouse.

• All individuals in the household are U.S. citizens with valid Social Security numbers. No one has a disability. They lived in the United States all year.

Alice Adams – Test Questions;

9. For the purpose of determining dependency, Nancy could be the qualifying child of _______________.a. Only Alice

b. Only Linda

c. Either Alice or Linda Answer

d. Neither Alice nor Linda

Alice Adams – Question 9 Explanation;

10. Linda is not eligible to claim Nancy for the earned income credit because her filing status is Married Filing Separate.

a. True b. False> Answer

Alice Adams – Question 10 Explanation:

To figure the credit, see Publication 596, Earned Income Credit 2022. When you file Form 1040 or 1040-SR, you must attach Schedule EIC to your return to claim the EIC with a qualifying child.

Special rule for separated spouses: You can claim the EIC if you are married, not filing a joint return, had a qualifying child who lived with you for more than half of 2022 and either of the following apply:

1. You lived apart from your spouse for the last 6 months of 2022, or

2. You are legally separated according to your state law under a written separation agreement or a decree of separate maintenance and you didn't live in the same household as your spouse at the end of 2022.

a. True b. False Answer

Alice Adams – Retest Question 9 Explanation:

10. Which of the following statements is true?a. Linda is not eligible to claim Nancy for the EIC because her filing status is married filing separate.

b. Linda is not eligible to claim the EIC for Nancy because she is under age 25.

c. Linda is not eligible to claim Nancy for the EIC because her income is too high.

d. None of the above statements are true. Answer

Alice Adams Retest Question 10 – Explanation:

Ellen Black Interview Notes:

• Ellen is 48 years old and files as single.• Her 2022 adjusted gross income (AGI) is $51,000, which includes gambling winnings of $2,000.

• Ellen would like to itemize her deductions this year.

• Ellen brings documents for the following expenses:

o $9,000 Hospital and doctor bills

o $500 Contributions to Health Savings Account (HSA)

o $3,600 State withholding (higher than Ellen's calculated state sales tax deduction)

o $300 Personal property taxes based on the value of the vehicle

o $400 Friend’s personal GoFundMe campaign

o $275 Cash contributions to the Red Cross

o $200 Fair market value of clothing in good condition donated to the Salvation Army (Ellen purchased the clothing for $900)

o $7,300 Mortgage interest

o $2,300 Real estate tax

o $150 Homeowners association fees

o $3,000 Gambling losses

Ellen Black – Test Question

11. Ellen can claim the $400 she donated to her friend's personal GoFundMe campaign as a deduction on her Schedule A.a. True

b. False Answer

Ellen Black – Test Question 11 Explanation:

Money donated to personal GoFundMe campaign are not deductible.

12. What amount of gambling losses is Ellen eligible to claim as a deduction on her Schedule A?a. $0

b. $1,000

c. $2,000 Answer

d. $3,000

Ellen Black – Test Question 12 Explanation:

Ellen is eligible to claim $2,000 in gambling losses as a deduction on her Schedule A. You may deduct gambling losses only if you itemize your deductions on Schedule A (Form 1040) and kept a record of your winnings and losses.

The amount of losses you deduct can't be more than the amount of gambling income you reported on your return.

Ellen Black – Retest Questions;

11. If Ellen chooses to itemize, which of the following is she eligible to claim as a deduction on Schedule A?a. $400 GoFundMe donation

b. $500 Contributions to Health Savings Account (HSA)

c. $150 Homeowner’s Association fees

d. $300 Personal property taxes based on the value of her vehicle Answer

Ellen Black – Retest Question 11 Explanation:

Nondeductible payments; You can’t deduct any of the following items:$150 Homeowner’s Association fees

$400 GoFundMe donation

What are the benefits of an HSA? HSA contributions are not deductible on Schedule A.

You may enjoy several benefits from having an HSA.

You can claim a tax deduction for contributions you, or someone other than your employer, make to your HSA even if you don’t itemize your deductions on Schedule A (Form 1040).

12. Ellen is eligible to claim $3,000 in gambling losses as a deduction on her Schedule A.

a. True b. False Answer

Ellen Black – Retest Question 12 Explanation:

Ellen is eligible to claim $2,000 in gambling losses as a deduction on her Schedule A.

You may deduct gambling losses only if you itemize your deductions on Schedule A (Form 1040) and kept a record of your winnings and losses.

The amount of losses you deduct can't be more than the amount of gambling income you reported on your return.

• David works at a gas statopm and earned $18,500 in wages.

• David took two management courses at a community college to improve his job skills. He was less than a half time student. He wants to know if that qualifies for any educational tax benefit.

• David took an early distribution from his IRA of $2,000 for tuition and $500 for emergency repairs of his air conditioning system. This is the first time he has taken a distribution from his IRA. • David is a U.S. citizen and lived in the U.S. for the entire year. He has a valid Social Security number.

David Stone – Test Questions: 13. David is eligible to claim the American Opportunity Credit on his 2024 tax return. a. True

b. False ANSWER

David Stone – Test Question 13 Explanation:

Reference:

IRS Publication 970, Tax Benefits for Education.

To be eligible for Lifetime Learning Credit (LLC), the student must:

- Felony drug conviction doesn’t make the student ineligible for Lifetime Learning Credit.

- Information can be found in Publication 970, Tax Benefits for Education.

- Be enrolled or taking courses at an eligible educational institution.

- Be taking higher education course or courses to get a degree or other recognized education credential or to get or improve job skills.

- Be enrolled for at least one academic period beginning in the tax year.

- You can't claim the credit if your MAGI is $90,000 or more ($180,000 or more if you file a joint re-turn).

a. John must have a Social Security number valid for employment.

b. John must be a full time student. Answer

c. John must not be the dependent of another taxpayer.

d. John must have lived in the United States more than half the year.

John Ward – Test Question 14 Explanation:

To be eligible for Lifetime Learning Credit (LLC), the student must:

- Felony drug conviction doesn’t make the student ineligible for Lifetime Learning Credit.

- Information can be found in Publication 970, Tax Benefits for Education.

- Be enrolled or taking courses at an eligible educational institution.

- Be taking higher education course or courses to get a degree or other recognized education credential or to get or improve job skills.

- Be enrolled for at least one academic period beginning in the tax year.

- You can't claim the credit if your MAGI is $90,000 or more ($180,000 or more if you file a joint re-turn).

John Ward – Retest Questions;

13. Which of the following is a requirement for John to claim the lifetime learning credit in 2022?a. John must be at least a half-time student.

b. John must be a degree candidate at an eligible educational institution.

c. John's modified adjusted gross income (MAGI) must be less than $90,000. Answer

d. John must have no felony drug convictions.

John Ward Retest Question 13 – Explanation:

Reference: Publication 970, Tax Benefits for Education. The lifetime learning credit is phased out if your MAGI is between $80,000 and $90,000 ($160,000 and $180,000 if you file a joint return).

To be eligible for LLC, the student must: Be enrolled or taking courses at an eligible educational institution.Be taking higher education course or courses to get a degree or other recognized education credential or to get or improve job skills. Be enrolled for at least one academic period* beginning in the tax year.

You can't claim the credit if your MAGI is $90,000 or more ($180,000 or more if you file a joint re-turn).

14. John is eligible to claim the earned income credit on his 2022 tax return.a. True Answer b. False

John Ward Retest Question 14 – Explanation:

Must be at least age 25 but under age 65 as of December 31 with earned income below $21,430 for those filing single and $27,380 for spouses filing a joint return.

The maximum credit for taxpayers with no qualifying children is $1,502.

Using the tax software, complete the tax return, including Form 1040 and all appropriate forms, schedules, or worksheets. Answer the questions following the scenario.

When entering Social Security numbers (SSNs) or Employer Identification Numbers (EINs), replace the Xs as directed, or with any four digits of your choice.

Robert and Emily Lincoln – Interview Notes:

• Robert is a 6th grade teacher at a public school. Robert and Emily are married and choose to file Married Filing Jointly on their 2022 tax return.• Robert worked a total of 1,340 hours in 2022. During the school year, he spent $733 on unreimbursed classroom expenses.

• Emily retired in 2019 and began receiving her pension on November 1st of that year. She explains that this is a joint and survivor annuity. She has already recovered $1,216 of the cost of the plan.

• Robert settled with his credit card company on an outstanding bill and brought the Form 1099-C to the site. They aren’t sure how it will impact their tax return for tax year 2022. The Lincolns determined that they were solvent as of the date of the canceled debt.

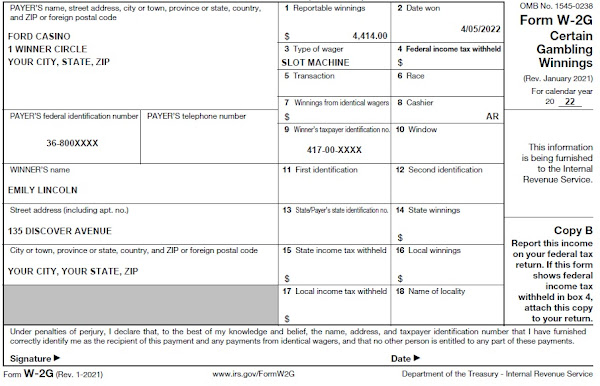

• Emily won $4,414 gambling at a casino and had additional lottery winnings of $175. Emily has documented casino losses of $1,260.

• Their daughter, Safari, is in her second year of college pursuing a bachelor’s degree in Veterinary Medicine at a qualified educational institution. She received a scholarship and the terms require that it be used to pay tuition. Box 2 was not filled in and Box 7 was not checked on her Form 1098-T for the previous tax year. The Lincolns provided Form 1098-T and an account statement from the college that included additional expenses. The Lincolns paid $865 for books and equipment required for Safari's courses. This information is also included on the college statement of account. The Lincolns claimed the American Opportunity Credit last year for the first time.

• Safari does not have a felony drug conviction.

• They are all U.S. citizens with valid Social Security numbers.

2022 LINCOLN FEDERAL RETURN CUSTOMER’S DOCUMENTS:

2022 LINCOLN FEDERAL RETURN LIST OF IRS FORMS:

2022 LINCOLN FEDERAL RETURN QUICK SUMMARY – IRS:

FILING STATUS: 2 (MFJ)

TOTAL INCOME: 75908

ADJUSTMENTS TO INCOME: 300

ADJUSTED GROSS INCOME: 75608

STANDARD DEDUCTION: 27300

TAXABLE INCOME: 48308

TAX: 5394

TOTAL CREDITS: 1893 (500 OTHER DEPENDENT + 1393 EDUCATION)

TOTAL TAX: 3501

TOTAL PAYMENTS: 7963 (7035 TAX WITHHELD + 928 REFUNDABLE)

REFUND: 4468

Advanced Scenario 7: Robert and Emily Lincoln – Test Questions;

15. What is the taxable portion of Emily's pension from Maple Enterprises using the simplified method?a. $0

b. $17,415

c. $18,789 Answer

d. $19,350

Robert and Emily Lincoln – Question 15 Explanation:

• Robert Lincoln 2022 – 1961 = 61

• Emily Lincoln 2022 – 1954 = 68

• 61 + 68 = 129 from Table 2 121 – 130 = 310

Partially Taxable Pensions and Annuities:

• Simplified Method: You must use the Simplified Method if the payments are from a qualified employee plan or a qualified employee annuity.

• Enter the total pension or annuity payments from Form 1099-R, box 1 on line 5a. If your Form 1099-R doesn't show the taxable amount, you must use the Simplified Method to figure the taxable part to enter on line 5b.

• If your Form 1099-R shows a taxable amount, you can report that amount on line 5b. But you may be able to report a lower taxable amount by using the Simplified Method

. • If you must use the Simplified Method, complete the Simplified Method Worksheet in 2022 1040 instructions to figure the taxable part of your pension or annuity.

• You can ask the IRS to figure the taxable part for you for a $1,000 fee. For details, see Pub. 939.

16. All of Emily's social security income is taxable.

a. True b. False Answer

Robert and Emily Lincoln – Question 16 Explanation:

IRS Notice 703: You were married, would file jointly, and line E above is more than $32,000. 21203 / 2 = 10602 plus total income 33657 = 44259 minus 32000, then some of the social security income is taxable. Up to 85% of a taxpayer's benefits may be taxable if they are: Married filing jointly with more than $44,000 income. 21203 x .85 = 18023 Answer.

17. What is the total amount of other income reported on the Lincoln's Form 1040, Schedule 1?

a. $5,439 Answer

b. $5,264

c. $4,589

d. $850

Robert and Emily Lincoln – Question 17 Explanation;

Cancellation of credit card debt is included in the Income – Other Income lesson of Publication 4491 2022 RETURNS.

Form 1099-C: If a taxpayer receives Form 1099-C for canceled credit card debt and was solvent (assets greater than liabilities) immediately before the debt was canceled, all the canceled debt will be included on the tax return as other income.

Examples of "Other Income" on Schedule 1:

- Gambling winnings, 4,414 + 175 + 850 = 5,439 Answer

- Lotteries, 175

- Nonbusiness credit card debt cancellation, 850

Robert and Emily Lincoln – Question 18 Explanation:

An eligible educator is a kindergarten through grade 12 teacher, who worked in a school for at least 900 hours during a school year. If you were an eligible educator in 2022, you can deduct qualified expenses up to $300 you paid in 2022 in the Adjustments to Income section of Schedule 1 (Form 1040), line 11.

19. What is the Lincoln's standard deduction on their 2022 tax return?

a. $28,700

b. $27,300 Answer

c. $25,900

d. $19,400

Robert and Emily Lincoln – Question 19 Explanation:

IF your filing status is Married filing jointly AND the number of boxes checked is 1 THEN your standard deduction is $27,300 Anawer.

20. Which is not a qualifying expense for the American opportunity credit?

a. Parking pass Answer

b. Required course related books

c. Tuition

d. Required course related equipment

Robert and Emily Lincoln – Question 20 Explanation:

Expenses eligible for the American Opportunity Credit: Qualified education expenses include amounts spent for tuition and materials for course enrollment. This includes books, supplies, and equipment needed for a course of study. Parking pass is not a qualifying expense for the American Opportunity Credit.

21. Which of the following credits are the Lincolns eligible to claim on their tax return?

a. Child tax credit

b. Credit for other dependents

c. American opportunity credit

d. Only b and c Answer

Lincoln Advanced Test – Question 21 Explanation:

To qualify for the Credit for Other Dependents: There is a $500 credit for other dependents who do not qualify for the $2,000 child tax credit. The dependent must be a U.S citizen, U.S. national, or resident of the U.S. The dependent must have a valid identification number (ATIN, ITIN, or SSN).

To qualify for the American Opportunity Credit: To be eligible for AOTC, the student must be pursuing a degree or other recognized education credential. Be enrolled at least half time for at least one academic period beginning in the tax year. Not have finished the first four years of higher education at the beginning of the tax year.

22. What is the Lincoln’s total federal income tax withholding? $__________. 7035 Answer

Robert and Emily Lincoln – Question 22 Explanation:

3,000 W-2 + 2,100 SSA-1099 + 1,935 1099-R = $7,035 Answer.

Advanced Scenario 7: Robert and Emily Lincoln – Retest Questions;

15. The taxable portion of Emily's pension from Maple Enterprises using the simplified method is $19,350.a. True b. False Answer

16. The taxable amount of Emily's social security income is:

a. $21,203

b. $18,023 Answer

c. $17,062

d. $0

17. The total amount of other income reported on the Lincoln's Form 1040, Schedule 1 is $850.

a. True b. False Answer

18. What is the amount Robert is eligible to claim as qualified educator expenses on Form 1040, Schedule 1?

a. $0

b. $250

c. $300 Answer

d. $733

19. The Lincoln's standard deduction on their Form 1040 for tax year 2022 is $25,900.

a. True b. False Answer

20. Which of the following expenses qualify for the American opportunity credit?

a. Required course related books and equipment

b. Tuition

c. Parking pass

d. Both a and b Answer

21. The Lincolns can claim the credit for other dependents for their daughter Safari.

a. True Answer

b. False

22. How much federal income tax withholding is reported on the Lincolns' Form 1040?

a. $1,935

b. $3,000

c. $4,935

d. $7,035 Answer

Joanne Oak – Interview Notes:

2022 SCENARIO 8 JOANNE OAK FEDERAL RETURN CUSTOMER'S DOCUMENTS:2022 SCENARIO 8 JOANNE OAK FEDERAL RETURN LIST OF FORMS;

Form 8879 is the declaration document and signature authorization for an e-filed return filed by an electronic return originator (ERO).

Complete this form when:

• The Practitioner PIN method is used.

• The taxpayer authorizes the ERO to enter or generate the taxpayer’s personal identification number (PIN) on his/her e-filed individual income tax return.

IRS Determining Your Qualified Business Income Instructions for Form 8995:

IRS Qualified business income for Form 8995 equals to Net Profit Schedule C Line 31 = 6457 minus Deduction for one-half of Self-Employment Tax Schedule SE Line 13 = 456.

6457 - 456 = 6001 Enter on line 1(c) the net qualified business income or (loss) for the trade, business, or aggregation reported in the corresponding row.FILING STATUS: 1 (SINGLE)

TOTAL INCOME: 48444

EXPLANATION: (FORM 1040 LINE 9 48444 = 36050 W-2 + 12 INTEREST + 225 DIVIDENTS + 2500 IRA + SCHEDULE C 6457 + SCHEDULE D 3200)

TOTAL ADJUSTMENTS TO INCOME: 2956

EXPLANATION: (FORM 1040 LINE 10 2956 = DEDUCTABLE SELF-EMPLOYMENT TAX SCHEDULE 1 LINE 15 456 + STUDENT LOAN INTEREST SCHEDULE 1 LINE 25 2500)

ADJUSTED GROSS INCOME (AGI): 45488

EXPLANATION: (FORM 1040 LINE 11 45488 = 48444 MINUS 2956)

STANDARD DEDUCTION: 12950

TAXABLE INCOME: 31332

EXPLANATION: (FORM 1040 LINE 15 31332 = 45488 (AGI) - 12950 - 1206 QUALIFIED BUSINESS DEDUCTION LINE 13 FORM 1040)

TAX: 3242

EXPLANATION: (CALCULATED USING QUALIFIED DIVIDENTS AND CAPITAL GAIN TAX WORKSHEET—Line 16)

CREDITS: 480

EXPLANATION: (FORM 1040 LINE 20 FROM EDUCATION CREDIT SCHEDULE 3 LINE 3)

OTHER TAXES: 1162

EXPLANATION: (1162 FORM 1040 LINE 23 OTHER TAXES FROM SCHEDULE 2 LINE 21 = SCHEDULE 2 LINE 4 SELF-EMPLOYMENT TAX 912 + SCHEDULE 2 LINE 8 ADDITIONAL TAX ON IRA 250))

TOTAL TAX: 3924

EXPLONATION: (FORM 1040 LINE 24 3924 = TAX 3242 - 480 FROM SCHEDULE 3 LINE 20 EDUCATION CREDIT + 1162 OTHR TAX FROM SCHEDULE 2 LINE 23)

TOTAL PAYMENTS: 3050

EXPLANATION: (3050 = 2800 FORM W-2 + 250 FORM 1099-R)

AMOUNT DUE: 874

EXPLANATION: (874 = TOTAL TAX 3924 FORM 1040 LINE 24 - TOTAL PAYMENTS 3050 FORM 1040 LINE 33)

| 2022 SCENARIO 8 OAK FEDERAL RETURN | SUMMARY |

|---|---|

| FILING STATUS: | 1 (SINGLE) |

| TOTAL INCOME: | 48444 |

| TOTAL ADJUSTMENTS TO INCOME: | 2956 |

| ADJUSTED GROSS INCOME: | 45488 |

| STANDARD DEDUCTION: | 12950 |

| TAXABLE INCOME: | 31332 |

| TAX: | 3242 |

| CREDITS: | 480 |

| OTHER TAXES: | 1162 |

| TOTAL TAX: | 3924 |

| TOTAL PAYMENTS: | 3050 |

| AMOUNT DUE: | 874 |

Advanced Scenario 8: Joanne Oak – Test Questions;

23. What is the net long term capital gain reported on Joanne's Schedule D?a. $2,450 Answer

b. $2,100

c. $1,750

d. $350

Joanne Oak – Question 23 Explanation:

$2,100 + $350 = $2,450

Capital Gain Distributions Line 13: Enter on Schedule D, line 13, the total capital gain distributions paid to you during the year, regardless of how long you held your investment. This amount is shown in box 2a of Form 1099-DIV below. Capital Gain Distributions Line 18: If there is an amount in box 2d of the Form 1099-DIV, include that amount on line 4 of the 28% Rate Gain Worksheet in these instructions if you complete line 18 of Schedule D. 24. Which of the following can be claimed as a business expense on Joanne's Schedule C?

a. Car washes

b. Tickets for illegal parking

c. Tolls Answer

d. Snacks and lunches

Joanne Oak – Question 24 Explanation:

Tolls: You can deduct the standard mileage rate, as well as business-related tolls and parking fees. Oct 6, 2022

Snacks and lunches: For 2021 and 2022 only, businesses can generally deduct the full cost of business-related food and beverages purchased from a restaurant. Otherwise, the limit is usually 50% of the cost of the meal. Jun 14, 2022

25. What is the amount Joanne can take as a student loan interest deduction on her Form 1040, Schedule 1? $__________________. 2500 Answer

Joanne Oak – Question 25 Explanation:

Student loan interest is interest you paid during the year on a qualified student loan. It includes both required and voluntarily pre-paid interest payments. You may deduct the lesser of $2,500 or the amount of interest you actually paid during the year.

26. How many miles can Joanne use to calculate her standard mileage deduction?

a. 1,500

b. 2,500 Answer

c. 4,000

d. 11,000

Joanne Oak – Question 26 Explanation:

If you take the standard mileage rate:

• Multiply the business standard mileage rate from January 1, 2022, to June 30, 2022, by 58.5 cents a mile;

• Multiply the business standard mileage rate from July 1, 2022, to December 31, 2022, by 62.5 cents a mile; and

• Add to this amount your parking fees and tolls; and

• Enter the total on line 9.

27. What is the amount of Joanne's lifetime learning credit? $_______________. 480 Answer.

Joanne Oak – Question 27 Explanation:

How to figure the amount of Lifetime Learning Credit and Qualified Expenses:

Tuition and required enrollment fees (including amounts required to be paid to the institution for course-related books, supplies, and equipment). The amount of the credit is 20 percent of the first $10,000 of qualified education expenses or a maximum of $2,000 per return. Lifetime learning credit equals 20% of qualified education expenses. 2400 Tuition x .20 = 480 Answer.

28. Joanne will have to pay $________ 10 additional tax because she received the early distribution from her IRA.

Joanne Oak – Question 28 Explanation:

Joanne will be subject to the additional 10% tax if no exception applies. Because, Joanne used only a portion of the IRA distribution for the qualified higher education expenses, she has to pay additional $250 tax penalty for the IRA early distribution. Also, please note, there is an error, the $10 should have been $250.

29. How can Joanne prevent having a balance due next year?

a. She can increase the withholding on her Form W-4.

b. She can make estimated tax payments.

c. She can use the IRS withholding calculator to estimate her withholding for next year.

d. All of the above Answer

Joanne Oak – Question 29 Explanation:

Having enough tax withheld or making quarterly estimated tax payments during the year can help Joanne avoid problems at tax time. Another way to pay taxes is to pay-as-you-go. This means that you need to pay most of your tax during the year, as you receive income, rather than paying at the end of the year.

Advanced Scenario 8: Joanne Oak – Retest Questions;

23. Joanne's net long-term capital gain reported on Schedule D is $_______. 2450 Answer.(2100 + 350 = 2450).

24. Joanne cannot claim the $150 for illegal parking tickets as a business expense on Schedule C.

a. True Answer b. False

25. What is the amount Joanne can take as a student loan interest deduction on her Form 1040, Schedule 1?

a. $3,250

b. $2,500 Answer

c. $750

d. $0

26. How many miles can Joanne use to calculate her standard mileage deduction? ______________. 2500 Answr

27. Joanne meets the qualifications to claim the Lifetime Learning Credit.

a. True Answer b. False

28. What is Joanne's additional 10% tax on the early withdrawal from her IRA?

a. $0

b. $10Answer

c. $240

d. $250

29. Joanne can make estimated tax payments to avoid owing tax next year.

a. True Answer

b. False

Thomas Polk – Interview Notes:

FORM W-2

FORM 1099-INT (INTEREST INCOME)

FORM 1095-A (HEALTH INSURANCE MARKETPLACE STATEMENT)

DOWNTOWN DAY CARE STATEMENT (CHILDCARE EXPENSES)

FORM 8879 (E-FILE SIGNATURE AUTHORIZATION)

FORM 1040 (TAX RETURN)

SCHEDULE 1 (ADDITIONAL INCOME AND ADJUSTMENTS TO INCOME)

SCHEDULE 3 (ADDITIONAL CREDITS AND PAYMENTS)

SCHEDULE B (INTEREST AND DIVIDENTS INCOME)

FORM 2441 (CHILD CARE CREDIT)

FORM 2441 (CHILD CARE CREDIT) LINE 10 CREDIT LIMIT WORKSHEET

SCHEDULE EIC (EARNED INCOME CREDIT)

WORKSHEET A – 2022 EIC FORM 1040 – LINE 27

SCHEDULE 8812 (CHILD TAX CREDIT AND ADITIONAL CHILD TAX CREDIT)

SCHEDULE 8812 LINE 13 CREDIT LIMIT WORKSHEET

FORM 8880 (RETIREMENT SAVINGS CREDIT)

FORM 8962 (PREMIUM TAX CREDIT)

2022 SCENARIO 9 POLK – IRS RETURN: SUMMARY

FILING STATUS 4 (HEAD OF HOUSEHOLD)

INCOME 41130

ADJUSTMENTS TO INCOME 26

ADJUSTED GROSS INCOME AGI 41104

DEDUCTIONS 19400

TAXABLE INCOME 21704

TAX 2314 (FROM IRS 2022 TAX TABLE)

CREDITS 2314

PAYMENTS 3264

REFUND 3264

Advanced Scenario 9: Thomas Polk – Test Questions;

30. What is Thomas's most advantageous filing status?a. Single

b. Married Filing Separately

c. Head of Household Answer

d. Qualifying Surviving Spouse (QSS)

Thomas Polk – Question 30 Explanation:

Surviving spouses who have an eligible child may be able to use the Qualifying Surviving Spouse status in the two tax years following the year of the spouse’s death. Thomas was widowed in 2019. 2022 is the third year after 2019 therefore Thomas’s most advantageous filing status is Head of Household.

31. Thomas's adjusted gross income on his Form 1040 is $__________. 41104 Answer.

Thomas Polk – Question 31 Explanation:

On 2022 tax return, your AGI is on line 11 of the Form 1040. And it equals to line 10 Adjustments to Income from Schedule 1, line 26 subtracted from Total Income on line 9 of your Form 1040.

32. Thomas can claim the following credits on his tax return.

a. Child Tax Credit

b. Child and Dependent Care Credit

c. Premium Tax Credit

d. All of the above Answer

Thomas Polk – Question 32 Explanation:

33. Thomas's Retirement Savings Contributions Credit on Form 8880 is $___________. 100 Answer.

Thomas Polk – Question 33 Explanation:

Form W-2 Box 12a D is for 401(k) contributions You may be able to claim the Saver's Credit, Form 1040 Schedule 3, line 4. Line 11 Adjusted Gross Income (AGI).

34. The total amount of Thomas's advanced payment of premium tax credit for 2022 is $___________. 4656 Answer.

Thomas Polk – Question 34 Explanation:

35. Thomas's child and dependent care credit from Form 2441 is reported as a non-refundable credit on Form 1040, Schedule 3.

a. True Anawer b. False

Thomas Polk – Question 35 Explanation:

For 2022, the credit for child and dependent care expenses is nonrefundable and you may claim the credit on qualifying employment-related expenses of up to $3,000 if you had one qualifying person, or $6,000 if you had two or more qualifying persons.

The maximum credit is 35% of your employment-related expenses if your adjusted gross income is $15,000 or less. Reference: IRS Publication 503 2022 Child and Dependent Care Expenses.

a. True b. False Answer

31. What is Thomas's adjusted gross income on his Form 1040?

a. $41,130

b. $41,104 Answer

c. $41,000

d. $21,704

32. Thomas is eligible to claim the credit for other dependents in 2022.

a. True b. False Answer

33. Thomas qualifies to claim a retirement savings contribution credit.

a. True Anawer b. False

34. What is the total amount of advanced payment of premium tax credit that Thomas received in 2022?

a. $7,224

b. $5,352

c. $4,656 Answer

d. $388

35. Thomas's child and dependent care credit is refundable in 2022.

a. True b. False Answer

The first five questions are about how to calculate the allowable portion of standard deductions to U.S. income. Use your VITA Puerto Rico Resource Guide Publication 4696PR and Publication 1321 to answer the questions.

1. Lauren was a resident of Puerto Rico during 2022. She is single and under 65 years of age. She works as a U.S. government employee and her salary was $34,000. She also received income of $6,000 from a part-time job in Puerto Rico not subject to U.S. tax. What is the allowable portion of the standard deduction that Lauren can claim?a. $11,008 ANSWER

2. German and Elena were residents of Puerto Rico in 2022. They are age 72 and file a joint return. German is retired from the U.S. Postal Service and Elena is retired from the U.S. Veterans Affairs. Their taxable pensions were $28,000 and $42,000, respectively What is German and Elena’s standard deduction?

d. $28,700 ANSWER

3. Marco is 40 years old, qualifies to file Head of Household, and a resident of Puerto Rico during 2022. He informed you that he received the following sources of income: $12,500 for a job he performed in the state of Florida; $23,200 received from the federal government for services performed in Puerto Rico. He also received $6,300 from a part-time job in Puerto Rico that is exempt from federal income tax. What is the allowable portion of Marco’s standard deduction?

b. $16,490 ANSWER

Calculation: $12,500 and $23,200 and $6,300 35700/42000=0.85

Head of household under 65 enter $19,400x.85=$16490

4. Camilo is a bona fide resident of Puerto Rico, who received Social Security benefits and pension income from the University of Puerto Rico. Does Camilo have U.S. source income?

a. Yes, he has U.S. source income. ANSWER

5. Paloma is single and received unemployment benefits from the Puerto Rico Department of Labor reported on a Form 1099-G. What is the factor determining source of income for unemployment?

c. Unemployment compensation is generally considered sourced where the taxpayer performed the underlying services. ANSWER

b. $3,000 ANSWER

7. What filing status can Kenya use?

a. Head of Household ANSWER

8. Kenya can file Form 1040-PR or Form 1040-SS to claim the Additional Child Tax credit.

a. True ANSWER

9. The IRS issues an Identity Protection Personal Identification Number (IP PIN) to protect and confirm taxpayer identity when submitting a tax return. Should the IP PIN be included on the Form 1040SS or Form 1040PR?

a. Yes ANSWER

10. Kenya must have earned income to be able to claim the Additional Child Tax Credit.

a. True ANSWER

b. Married Filing Jointly ANSWER

12. How many dependents are eligible for the Additional Child Tax Credit (ACTC)?

b. 3 ANSWER

13. How much is the Additional Child Tax Credit that Antoni and Marta are entitled to receive?

b. $3,213 ANSWER

14. Which of the following income must be reported on Form 1040 PR or Form 1040 SS, Part II, Line 1 to calculate the modified adjusted gross income?

a. Wages and Unemployment

b. Taxable Pension and Annuities

c. Taxable Social Securities Benefits

d. All of the above. ANSWER

15. Which form should be completed by Antoni and Marta to claim the Additional Child Tax Credit?

c. Form 1040-PR or Form 1040-SS ANSWER

2. And for calculating the source of pension income for service performed in the U.S.;

3. And for determining the taxable portion of Social Security benefits.