IRS Get Refund Status Page Fast:

Click the link here to get to Get Refund Status page fast.Your Uber – Lyft Driver Tax Return TY 2019 in 9 Easy Steps:

KENNETH KANTER, UBER – LYFT Driver, Quick REFUND SUMMARY:

01 Line AGI = $13,461: Your Adjusted Gross Income from Form 1040, line 8b.02 Line Federal = -$1,988: Your Federal Tax You Owe.

03 Line State – CA = $129: Your California Tax Refund.

KENNETH R KANTER, UBER – LYFT Driver, 2019 RETURN FORMS LISTING:

01. FORM 1040 (U.S. Individual Income Tax Return)02. SCHEDULE 1 (Additional Income and Adjustments to Income)

03. SCHEDULE 2 (Additional Taxes)

04. SCHEDULE C (Profit or Loss From Business)

05. SCHEDULE SE (Self-Employment Tax (Section B–Long)

06. FORM 8995 (Qualified Business Income Deduction Simplified)

07. EIC WRKSH B (EIC with No Dependents)

08. FORM 8879 (IRS e-file Signature Authorization)

09. FORM 1040-V (Payment Voucher)

10. FORM 1099-K (Payment Card and Third Party Network Transactions)

11. FORM 1099-MISC (Miscellaneous Income)

12. FORM 540 (California Resident Income Tax Return)

13. FORM 3514 (California Earned Income Tax Credit)

14. FORM 8879 (California e-file Signature Authorization for Individuals)

Kenneth R. Kanter Form 1040 U.S. Individual Income Tax Return 2019, Page 1 and 2, lines 1-16:

01. Filing Status: Single check box;02. Your first name and middle initial: Kenneth R.

03. Last name: Kanter.

04. Your social security number: 543-00-1234

05. Home address (number and street): 8705 SOMERSBY WAY

06. City, State, and ZIP code: SAN FRANCISCO, CA 94110.

07. Line 7a = $14,485, this is Your Business Income from SCHEDULE 1, line 9. Enter on Form 1040, line 7a.

08. Line 8a = $1024, this is Your Deductible part of Your Self-Employment tax from SCHEDULE 1, line 14. Attach SCHEDULE SE.

09. Line 8b, $13,461 = $14,485 – $1,024, this is Your Adjusted Gross Income (AGI).

10. Line 9 = $12,200, this is Your Standard Deduction for Single tax payer.

11. Line 10 = $252, this is Your Qualified Business Income (QBI) deduction. Attach Form 8995.

12. Line 11b = $1,009, this is Your Taxable income.

13. Line 12a = $101, this is Your Tax from the Tax Table.

14. Line 15 = $2,047, this is Your Self-Employment Tax from SCHEDULE 2, line 10.

15. Line 18a = $160, this is Your Earned Income Credit (EIC).

16. Line 23 = $1988, this is Your Tax You Owe. Tax You Owe = $101 Tax + $2047 SE Tax – $160 EIC and that = $1988, Your Tax You Owe.

Schedule 1, Your Additional Income and Adjustments to Income, KENNETH KANTER, UBER – LYFT Driver:

Part I Additional Income: Lines 01 – 09.– 01 Name shown on Form 1040: KENNETH KANTER.

– 01 Your social security number: 543-00-1234.

– 02 Check Box: No; At any time during 2019, did you

acquire any financial interest in any virtual

currency?

– 03 Line 3, $14,485; Business income or (loss), Attach

Schedule C.

Enter 14,485 on Schedule 1, line 3, from

SCHEDULE C, line 31 Net profit or (loss),

$14,485 profit.

Enter 14,485 on Schedule SE, line 2.

– 09 Line 9, $14,485; Business income, enter on

Schedule 1, line 9.

– 09 Line 9, $14,485; Enter amount $14,485 on Form

1040, line 7a.

Part II Adjustments to Income: Lines 14 – 22.

– 14 Line 14, $1,024; Deductible part of

self-employment tax.

Enter amount $1,024 from Schedule SE, line 13.

Attach Schedule SE.

– 22 Line 22, $1,024; Amount $1,024 is Your

Adjustment to Income.

Enter the amount $1,024 on Schedule 1, line 22.

– 22 Line 22, $1,024; Enter the amount $1,024 on

Form 1040, line 8a.

SCHEDULE 1 QUICK SUMMARY: KENNETH KANTER, UBER – LYFT Driver 2019 RETURN.

Schedule 2, Your Additional Taxes, KENNETH KANTER, UBER – LYFT Driver:

Part l Tax: N/A.

Part ll Other Taxes: Lines 04 – 10.

– 04 Line 14 = $1,024. Your Deductible part of self-employment tax. Enter amount $1,024 from Schedule SE, line 13. Attach Schedule SE.

– 10 Line 10 = $2,753. Amount $2,753 is Your total other taxes. Enter the amount $2,753 on Schedule 2, line 10.

– 10 Line 10 = $2,753. Enter amount $2,753 on Form 1040, line 15.

SCHEDULE 2 QUICK SUMMARY: KENNETH KANTER, UBER – LYFT Driver, 2019 RETURN.

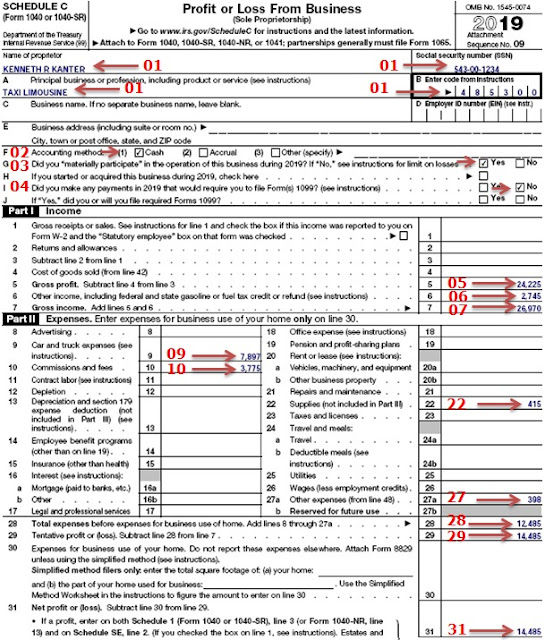

SCHEDULE C – Profit or Loss From Business, lines 5 – 31, KENNETH KANTER, UBER – LYFT driver:

– 01 Name of proprietor: KENNETH R KANTER– 01 Social security number (SSN): 543-00-1234

– 01 A Principal business: TAXI LIMOUSINE.

– 01 B Enter code from instructions: 485300.

– 02 F Accounting method: (1) Check the Box Cash.

– 03 G Did you materially participate in this business in 2019: Check Box Yes.

– 04 I Did you make any payments in 2019 that would require you to file Form(s) 1099? Check the Box: No.

• Form 1099-K: $24,000

• Form 1099-MISC: $225

• Cash Tips from customers: $2,745

• Gross profit, line 5: $24,225 (add 1099s)

• Other income, line 6: $2,745 Cash tips;

• Gross income, line 7: $26,970

(add lines 5 & 6).

– 05 Line 5, Gross profit: $24,225 Add two 1099s.

– 06 Line 6, Other income: $2,745 Cash Tips.

– 07 Line 7, Gross income: $26,970.00 Add lines 5 & 6.

$26,970.00 is Your Gross income on SCHEDULE C, line 7.

– 09 Line 9, Car and truck expenses: $7,897.

• You provided statement from Uber or Lyft Company that shows 10,200 miles driven transporting Your customers.

• Your record-keeping application (Stride Tax or MileIQ) shows you drove 3,415 miles between rides.

• Your Total miles driven for your expenses deduction equals to 10,200 + 3,415 and that equals to 13,615 total miles driven.

• Multiply your total mileage driven 13,615 miles by 0.58, your Standard mileage rate; 13,615 X 0.58 = 7,896.7 (7,897 rounded).

• And therefore, your Car expenses on SCHEDULE C, line 9 equal to $7,897.

– 10 Line 10, Commissions and fees: $3,775.

UBER tax summary:

• You provided your tax preparer with Uber tax summary statement from Uber or Lyft Company that shows fees you paid for the year.

These fees are considered ordinary and necessary for the ride-share business, and therefore tax deductible.

• Ride-share fee: $2,800

• Safe driver fee: $140

• Airport fee: $515

• GPS device fee: $320

– 22 Line 22, Supplies (not included in Part III): $415.00.

• Snacks and Drinks for passengers: $280

• Auto deodorizers: $15

• Phone charger for customer use only: $120

– 27 Line 27a, Other expenses (from line 48): $398.

• Tolls: $138

• Parking: $260

– 28 – Line 28, Your Total expenses: $12,485

• Add lines 8 though 27a, Your Total expenses: $12,485.

– 29 Line 29, Tentative profit or (loss): $14,485

• Subtract line 28, (Total expenses = $12,485) from line 7, (Gross income = $26,970), and that equals to $14,485 Your Tentative profit or (loss).

– 31 Line 31, Net profit or (loss): $14,485.

• Subtract line 30 (0) from line 29 ($14,845). Enter profit 14,845, on line 31.

• If profit, enter on Schedule 1, line 3.

• If profit, enter on Schedule SE, line 2.

SCHEDULE C – Profit or Loss From Business (Sheet 2), lines 33 – 48, KENNETH KANTER, UBER – LYFT driver.

SCHEDULE C, Part III – Cost of Goods Sold, lines 33, 34, KENNETH, UBER – LYFT driver:

01 – Line 33, Method(s) used to value closing inventory: a Cost. Check box: a.02 – Line 34, Was there any change in determining quantities, costs, or valuations between opening and closing inventory? Check box: No.

SCHEDULE C, Part IV – Information on Your Vehicle, lines 43 – 47b, and 48, KENNETH, UBER – LYFT driver:

03 – Line 43, When did you place your vehicle in service for business purposes? (month, day, year) 01/06/1917.04 – Line 44, Of the total number of miles you drove your vehicle during 2019, enter the number of miles you used your vehicle for:

05 – 44a Business miles: 13,615.

06 – 44b Commuting miles: 2,000.

07 – 44c Other miles: 5,225.

08 – Line 45, Was your vehicle available for personal use during off-duty hours? Check box: Yes

09 – Line 46, Do you (or your spouse) have another vehicle available for personal use? Check box: No

10 – Line 47a, Do you have evidence to support your deduction? Check box: Yes

11 – Line 47b, If “Yes,” is the evidence written? Check box: Yes

SCHEDULE C, Part V – Other Expenses, line 48, KENNETH, UBER – LYFT driver:

12 – TOLLS $138.13 – PARKING $260.

14 – Line 48, Total other expenses. Enter here and on line 27a. $398

– 9 Car and truck expenses, line 9: $7,897.

• You provided statement from Uber or Lyft Company that shows 10,200 miles driven transporting Your customers.

• Your record keeping application (Stride Tax or MileIQ) shows you drove 3,415 miles between rides.

• Your Total miles driven for your expenses deduction equals to 10,200 + 3,415 and that equals to 13,615 miles driven.

• Multiply your total mileage driven 13,615 miles by $0.58, your Standard Mileage Rate; 13,615 X 0.58 = 7,896.7 (7,897 rounded).

• And therefore, your Car expenses on Schedule C, line 9 equal to $7,897.

– 10 Commissions and fees, line 10: Total = $3,775

Uber tax summary:

• You provided tax preparer with Uber tax summary statement from Uber or Lyft Company that shows fees you paid for the year.

• These fees are considered ordinary and necessary for the ride share business, and therefore tax deductible.

• Ride-share fee: $2,800

• Safe driver fee: $140

• Airport fee: $515

• GPS device fee: $320

– 22 Supplies, line 22: Total = $415

• Snacks and Drinks for passengers: $280

• Auto deodorizers: $15

• Phone charger for customer use only: $120

– 27a Your Other expenses (from line 48), line 27a. Total = $398

Line 48, Total Other Expenses. Enter here (line 48) and on line 27a.

– 28 Schedule C,line 28, Your Total expenses.

• Add lines 8 though 27a, total expenses = $12,485.

– 29 Schedule C,line 29, Your Tentative profit or (loss).

• Subtract line 28 (Total expenses = $12,485) from line 7, (Gross income = 26,970), and that equals to 14,485 Your Tentative profit or (loss).

– 31 Schedule C, line 31, Net profit or (loss).

• Subtract line 30 (0) from line 29 ($14,845). Enter profit 14,845, on line 31.

• If profit, enter on both Schedule 1, line 3 and on Schedule SE, line 2.

3. Schedule C, lines 43 – 47b Information on Your Vehicle, Uber – Lyft driver:

– 43 When did you place your vehicle in service for business purposes?– 44a Business miles.

– 45 Was your vehicle available for personal use during off-duty hours? Yes

– 46 Do you (or your spouse) have another vehicle available for personal use? No

– 47a Do you have evidence to support your deduction? Yes

– 47b If “Yes,” is the evidence written? Yes

4. SCHEDULE SE, lines 2 – 13, Your Self-employment

Tax, KENNETH KANTER, UBER – LYFT driver:

01 Name of person with self-employment income: KENNETH R. KANTER. 02 SSN of person with self-employment income: 543-00-1234.

03 SCHEDULE SE, line 2, Net profit or (loss) from SCHEDULE C, line 31:

From SCHEDULE C, line 31 (14,485), enter Your Net profit (14,485) on SCHEDULE SE, line 2.

04 SCHEDULE SE, line 4a, multiply line 3 (14,485) by 92.35% (0.9235) = 13,377.

Enter amount 13,377 on line 4a. This is important to get the amount on line 6.

05 SCHEDULE SE, line 6, enter 13,377.

06 SCHEDULE SE, line 10. Multiply the smaller of line 6 or line 9 by 12.4% (0.124),

13,377 x 0.124 = 1,659 and enter on line 10. This Your Social Security Self-employment Tax.

07 SCHEDULE SE, line 11, multiply line 6 by 2.9% (0.029) $ 13,377 by 2.9% (0.029) to get $388.

This is your Medicare (hospital insurance) Self-employment Tax.

08 SCHEDULE SE, line 12, Your Self-employment tax. Add lines 10 and 11, 1,659 + 388 = 2,047.

Enter Your Self-employment tax 2,047 on SCHEDULE SE, line 12 and on SCHEDULE 2, line 4.

09 SCHEDULE SE, line 13, Deduction for Your one-half of self-employment tax:

Multiply line 12, (2,047) by 0.50 = 1,024. Enter the amount 1,024 on line 13.

The amount $1,024 is your one-half of your Self-employment tax you can deduct.

You deduct your one-half of your Self-employment tax on SCHEDULE 1, line 14, Deductible part of your Self-employment tax. Attach SCHEDULE SE.

5. Schedule 1, lines 3 – 22, Your Additional Income and

Adjustments to Income, Uber – Lyft driver:

– Check Box No for at any time during 2019, did you receive, sell, exchange,

or otherwise acquire any financial interest in any virtual currency?

– 3 Business income or (loss) = 19,485, enter on Schedule 1, line 3. Attach Schedule C.

– 9 Business income = 19,485, enter on Schedule 1, line 9.

–7a Enter Business income = 19,485 on Form 1040, line 7a.

–14 Schedule 1, line 14. Deductible part of self-employment tax. Enter amount 1,377 from Schedule SE, line 13. Attach Schedule SE.

–22 The amount on Schedule 1, line 14 = 1,377. This is Your adjustment to income. Enter the amount 1,377 on Schedule 1, line 22.

–8a Enter amount 1,377 on Form 1040, line 8a.

6. Schedule 2, lines 4 – 10, Your Additional Taxes,

Uber – Lyft driver:

– 4 Schedule 2, line 4, Self-employment tax. Attach Schedule SE. From

Schedule SE line 12 = 2,753 enter on Schedule 2 (Form 1040 or

1040-SR), line 4. – 10 Schedule 2, line 10. Add lines 4 through 8, and that = 2,753. These are Your total other taxes. Enter on Schedule 2, line 10 and on Form 1040, line 15.

7. Form 8995, lines 1i – 15, Your Qualified Business

Income Deduction, Uber – Lyft driver:

– 1i Form 8995, line 1i, Business Trade: Taxi Limousine. Line 1i (c)

18,108 and this is Your Qualified Business Income.– 4 Form 8995, line 4. 18,108 is Your Total Qualified Business Income.

– 5 Form 8995, line 5. 18,108 x .20 = 3,622 is Your Qualified Business Income component for deduction.

– 10 Form 8995, line 10. 3,622 is Your Qualified Business Income deduction before the income limitation.

– 11 Form 8995, line 11. 5,908 is Your Taxable Income before Qualified Business Income deduction.

– 14 Form 8995, line 14. Income limitation: Multiply 5,908 x .20 = 1,182. This is Your Qualified Business Income deduction.

– 15 Form 8995, line 15. Qualified Business Income deduction. Line 10 = 3,622, and line 14 = 1,182. Enter the lesser of line 10 or line 14. The lesser = 1,182, enter this amount on line 15 and also on Your Form 1040, line 10. Attach Form 8995.

8. EIC Worksheet B, Form 1040, line 18a, Your Earned Income Credit worksheet, Uber – Lyft driver:

9. Form 1040, lines 4 – 10, Your Additional Taxes, and Form 1040-V, Payment Voucher Uber – Lyft driver:

The Tax Information tab on your partner dashboard (partners.uber.com) will provide everything you need to file your taxes as an independent contractor.Why Pay?

The Good News:

You can choose the IRS VITA Certified EXPERTS – for FREE.

The maximum available refund direct deposited right into your bank account. You worked hard for your money.

The address is:

Fremont Family Resource Center, 39155 Liberty Street, Building EFGH, Fremont, CA 94538. Or for more info, call SparkPoint Fremont at (510) 574-2020.

Or Tax Professional will charge you $294 without Schedules and Forms plus the California state return another $100.

For your Schedules and Forms it could add up quickly:

$187 for Schedule C, Profit or Loss from Business,

$49 for Form 8965, Health Coverage Exemptions,

$52 for Form 1095-A, Health Insurance Marketplace Statement,

And your grand total could add up to $582.

You could save a lot of money to put in the bank on your account.

And get your tax return done and e-Filed all for free with IRS VITA in Fremont.

2019 UBER Sample Tax Return IRS VITA Certified;

FREMONT FAMILY RESOURCE CENTER,

Liberty Street, Building EFGH, Fremont,

CA 94538 or call SparkPoint Fremont (510) 574-2020

Invoice and QUICK SUMMARY KANTER UBER DRIVER 2019 Tax Return:

Your Step-by-Step Guide to file your UBER tax return with 2019 UBER Tax Summary, forms 1099-K and 1099-MISC.

Step 1: How to find your earnings on UBER Tax Summary 2019, 2019 forms 1099-K and 1099-MISC.

Your UBER Tax Summary 2919 Sample;

Your UBER form 1099-K Sample;

You should receive your form 1099-K from UBER by January 31st. You use the amount listed in the Box 1a Gross amount of payment card/third party network transactions to report your income on Schedule C.

The gross amount listed in Box 1a also includes the UBER’s fees. On Schedule C You’ll also deduct the UBER’s fees as your business expense.

Your UBER form 1099-MISC Sample;

You’ll receive form 1099-MISC from UBER if you’ve earned $600 or more for your extra affords as nonemployee compensation. On form 1099-MISC the Nonemployee compensation is listed in Box 7, Nonemployee compensation.

Step 2: How to report your earnings and forms you need to file:

You can either use tax software like TaxSlayer that does the calculation for you, or you can file your own forms manually, if you know what forms to use.

To file your 2019 self-employment tax return you need the following forms:

1. Form 1040, U.S. Individual Income Tax Return 2019;

2. Schedule 1, (Form 1040) Additional Income and Adjustments to Income 2019;

3. Schedule 2, (Form 1040) Additional Taxes 2019;

4. Schedule C, Profit or Loss from Business 2019;

5. Schedule SE, Self-Employment Tax, Section B – Long Schedule SE 2019;

6. Form 8995 Qualified Business Income Deduction 2019;

7. Form 1040-V Payment Voucher 2019;

How to file your own Schedule C Step-by Step:

You can use form 1099-K gross amount from Box 1a ($6,845.00) plus your form 1099-MISC amount from Box 7 ($3,859.00) to get your total gross earnings (“Gross receipts or sales”). Then, report your total gross income on your Schedule C line 7, as shown below.

Interview Notes – Kenneth R Kanter;

• IRS Form 13614-C 2019 Intake/Interview & Quality Review Sheet;Part I – Your Personal Information;

1. Your first name: Kenneth, M.I. R., Last name: Kanter. Daytime telephone number: 415-767-0230. Are you a U.S. citizen? Yes.

2. Mailing address: 8705 SOMERSBY WAY, SAN FRANCISCO, CA 94110.

3. Your Date of Birth: 7/11/1963. 4. Your job title: Self-Employed Driver. Kenneth’s marital status: Never Married. Kenneth’s Social Security Number and SS card: 543-00-1234.

Kenneth's Business Information:

– Kenneth is a cash-basis taxpayer who materially participates in the operation of his business.

– Kenneth did not make any payments that would require him to file Form 1099.

– Kenneth uses business code 485300.

– Kenneth had no prior year unalloyed losses.

Kenneth’s Business Income:

• Kenneth received Form 1099-MISC ($3,859.00) and Form 1099-K ($6,845.00) from the ride-share company. On the side, Kenneth also received an additional $5,000 in cash tip income from individual customers NOT included on the Forms 1099.

Kenneth’s Business Deductible Expenses:

1. Kenneth maintained a written record of mileage, reporting 9,075 business miles, and 2,000 commute miles driven between his home and his first and last customer of the day, 5,225 other miles.

2. Kenneth’s record-keeping application shows he drove 2,925 miles between rides.

3. Kenneth provided IRS certified volunteer tax preparer a statement from Uber Company that indicated the amount of mileage driven and fees paid for the year 2019. These fees are considered ordinary and necessary for the ride-share business.

3.1 Car and truck expenses: Total $6,960 on Schedule C, line 9.

– 9,075 miles driven while transporting customers; 9,075 + 2,925 miles between rides = 12,000 Total miles driven x 58 = $6,960 Total Car and truck expenses.

3.2 Commissions and fees: Total $2,775 on Schedule C, line 10.

– Ride-share fee: $1,800

– Safe driver fee: $140

– Airport fee: $515

– GPS device fee: $320 (Total = $2,775)

3.3 Supplies (miscellaneous expenses): Total $415 on Supplies, Schedule C, line 22.

– Snacks for customers: $280

– Auto deodorizers: $15

– Phone chargers for customer use only: $120

– Meals eaten while waiting for customers: $1,200 (Not deductible)

4. Kenneth spent $129 on tolls and $171 on parking, total = $300. Schedule C, Other Expenses. Line 48 Total other expenses. Enter here and on line 27a.

• Kenneth bought the car and placed his car, a 2016 sedan, in service on January 6, 2017. This is Ramon’s only car and it was available for personal use. The total mileage on his car for 2019 was 44,730 miles, off of that 5,225 was personal miles (Other miles).

• Kenneth did not have health insurance last year. If he has a balance due, he will mail the payment.

Note: To ensure the accuracy of the taxpayer’s return the IRS certified volunteer tax preparer should review and complete the applicable sections of the Form 13614-C.